Neiman Marcus 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 12. TRANSACTIONS WITH SPONSORS

Pursuant to a management services agreement with affiliates of the Sponsors, and in exchange for ongoing consulting and

management advisory services that are provided to us by the Sponsors and their affiliates, affiliates of the Sponsors receive an

aggregate annual management fee equal to the lesser of (i) 0.25% of our consolidated annual revenues or (ii) $10 million. Affiliates of

the Sponsors also receive reimbursement for out-of-pocket expenses incurred by them or their affiliates in connection with services

provided pursuant to the agreement. These management fees are payable quarterly in arrears. We recorded management fees of $10.0

million during fiscal year 2011, $9.2 million during fiscal year 2010 and $9.1 million during fiscal year 2009, which are included in

selling, general and administrative expenses in the consolidated statements of operations.

The management services agreement also provides that affiliates of the Sponsors may receive future fees in connection with

certain future financing and acquisition or disposition transactions. The management services agreement includes customary

exculpation and indemnification provisions in favor of the Sponsors and their affiliates.

NOTE 13. INCOME FROM CREDIT CARD PROGRAM

We have a marketing and servicing alliance with HSBC Bank Nevada, N.A. and HSBC Private Label Corporation

(collectively referred to as HSBC). Pursuant to the agreement with HSBC, HSBC offers proprietary credit card accounts to our

customers under both the "Neiman Marcus" and "Bergdorf Goodman" brand names. Our original program agreement with HSBC

expired in July 2010. Effective July 2010, we amended and extended our agreement with HSBC to July 2015 (renewable thereafter

for three-year terms).

Under the terms of the Program Agreement, HSBC offers credit cards and non-card payment plans and bears substantially all

credit risk with respect to sales transacted on the cards bearing our brands. We receive payments from HSBC based on sales

transacted on our proprietary credit cards. Such payments are subject to annual adjustments, both increases and decreases, based upon

the overall annual profitability and performance of the proprietary credit card portfolio. In addition, we receive payments from HSBC

for marketing and servicing activities we provide to HSBC.

NOTE 14. COMMITMENTS AND CONTINGENCIES

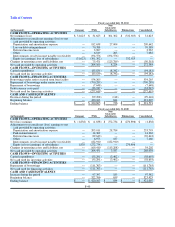

Leases. We lease certain property and equipment under various operating leases. The leases provide for monthly fixed

rentals and/or contingent rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes,

insurance, common area maintenance costs and other occupancy costs. Generally, the leases have primary terms ranging from three to

99 years and include renewal options ranging from two to 80 years.

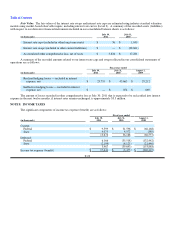

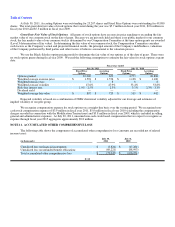

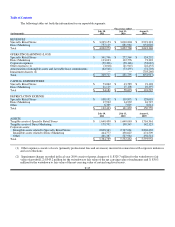

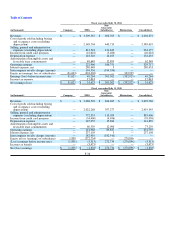

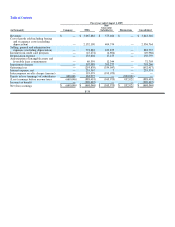

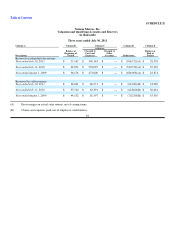

Rent expense and related occupancy costs under operating leases is as follows:

Fiscal year ended

(in thousands)

July 30,

2011

July 31,

2010

August 1,

2009

Minimum rent $ 55,800 $ 56,100 $ 55,400

Contingent rent 23,900 20,100 19,600

Other occupancy costs 14,400 15,100 15,700

Amortization of deferred real estate credits (6,500)(6,300)(5,300)

Total rent expense $ 87,600 $ 85,000 $ 85,400

Future minimum rental commitments, excluding renewal options, under non-cancelable leases are as follows: fiscal year

2012—$57.2 million; fiscal year 2013—$56.6 million; fiscal year 2014—$52.9 million; fiscal year 2015—$48.1 million; fiscal year

2016—$45.6 million; all fiscal years thereafter—$602.6 million.

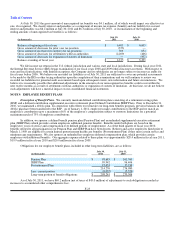

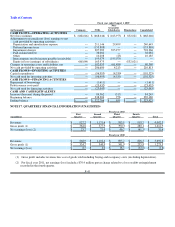

Long-term Incentive Plan. We have a long-term incentive plan (Long-term Incentive Plan) that provides for a cash

incentive payable to certain employees upon a change of control, as defined, subject to the attainment of certain performance

objectives. Performance objectives and targets are based on cumulative EBITDA (as defined in the plan) percentages for rolling three

year periods beginning in fiscal year 2006. Earned awards for each completed performance period will be credited to a book account

and will earn interest at a contractually defined annual rate until the award is paid. Awards will be paid upon a change of control, as

defined, or an initial public offering, as defined, subject to the requirement that, in each

F-33