Neiman Marcus 2010 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

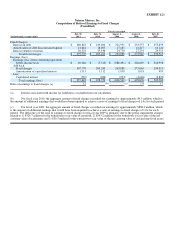

EXHIBIT 12.1

Neiman Marcus, Inc.

Computation of Ratio of Earnings to Fixed Charges

(Unaudited)

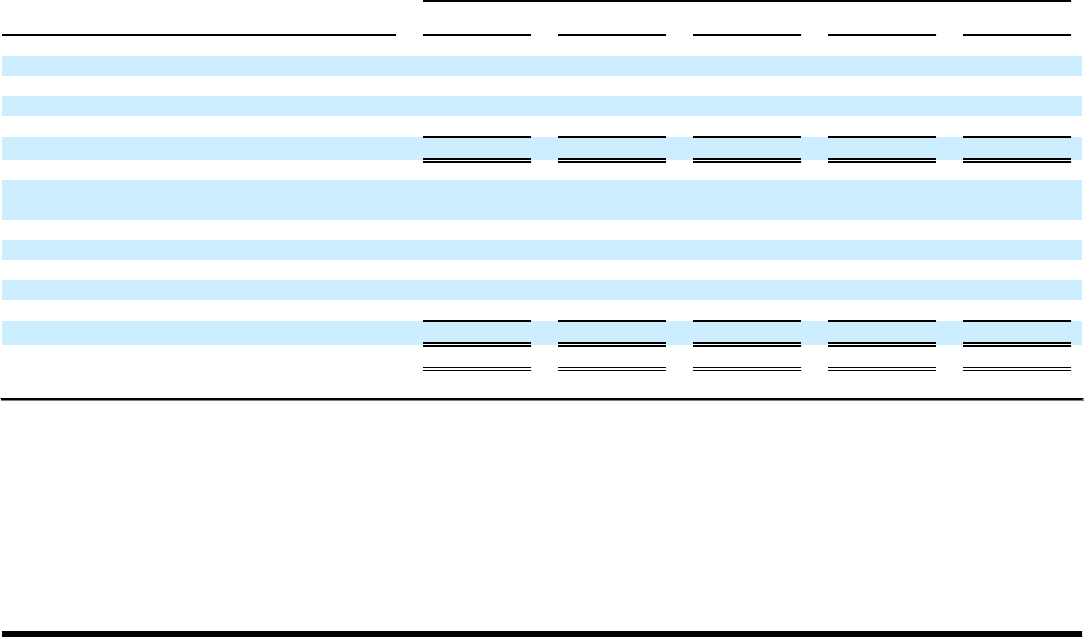

Fiscal year ended

(in thousands, except ratios)

July 30,

2011

July 31,

2010

August 1,

2009

August 2,

2008

July 28,

2007

Fixed Charges:

Interest on debt $ 266,816 $ 219,400 $ 221,951 $ 233,557 $ 255,859

Amortization of debt discount and expense 14,661 18,697 17,185 14,217 14,141

Interest element of rentals 26,301 25,146 24,750 27,291 24,915

Total fixed charges $ 307,778 $ 263,243 $ 263,886 $ 275,065 $ 294,915

Earnings (loss):

Earnings (loss) from continuing operations

before income taxes $ 49,264 $ (5,313) $ (888,491) $ 226,629 $ 216,998

Add back:

Fixed charges 307,778 263,243 263,886 275,065 294,915

Amortization of capitalized interest 1,115 1,112 1,058 1,018 495

Less:

Capitalized interest (535)(286)(993)(3,036)(2,825)

Total earnings (loss) $ 357,622 $ 258,756 $ (624,540) $ 499,676 $ 509,583

Ratio of earnings to fixed charges (a) 1.2

(b) (c) 1.8 1.7

(a) Interest associated with income tax liabilities is excluded from our calculation.

(b) For fiscal year 2010, the aggregate amount of fixed charges exceeded our earnings by approximately $4.5 million, which is

the amount of additional earnings that would have been required to achieve a ratio of earnings to fixed charges of 1.0x for such period.

(c) For fiscal year 2009, the aggregate amount of fixed charges exceeded our earnings by approximately $888.4 million, which

is the amount of additional earnings that would have been required to achieve a ratio of earnings to fixed charges of 1.0x for such

period. The deficiency of the ratio of earnings to fixed charges for fiscal year 2009 is primarily due to the pretax impairment charges

related to 1) $329.7 million for the writedown to fair value of goodwill, 2) $343.2 million for the writedown to fair value of the net

carrying value of tradenames and 3) $30.3 million for the writedown to fair value of the net carrying value of certain long-lived assets.