Neiman Marcus 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

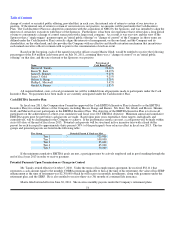

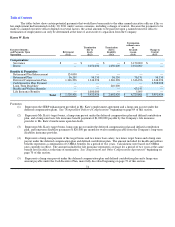

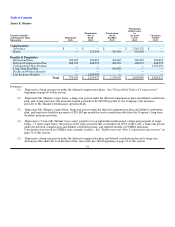

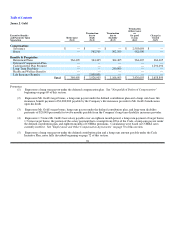

Table of Contents

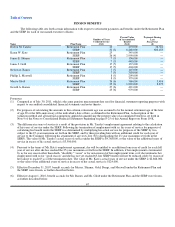

The Retirement Plan is a funded, tax-qualified pension plan. Prior to 2008, most non-union employees over age 21 who had

completed one year of service with 1,000 or more hours were eligible to participate in the Retirement Plan, which paid benefits upon

retirement or termination of employment. Effective as of December 31, 2007, eligibility and benefit accruals under the Retirement

Plan were frozen for all participants except for those "Rule of 65" employees who elected to continue participating in the Retirement

Plan. "Rule of 65" employees included only those active employees who had completed at least 10 years of service and whose

combined years of service and age equaled at least 65 as of December 2007. The Retirement Plan is a "career-accumulation" plan,

under which a participant earns each year a retirement annuity equal to one percent of his or her compensation for the year up to the

Social Security wage base and 1.5 percent of his or her compensation for the year in excess of such wage base. "Compensation" for

this purpose generally includes salary, bonuses, commissions and overtime but not in excess of the limits imposed upon annual

compensation under the Code Section 401(a)(17). Such limit for 2010 was $245,000 and remains unchanged for 2011 and is adjusted

annually for cost-of-living increases. Benefits under the Retirement Plan become fully vested after five years of service with us.

Effective August 1, 2010, benefit accruals were frozen for the remaining "Rule of 65" employees and such participants were given the

opportunity to participate in the RSP.

The SERP is an unfunded, nonqualified plan under which benefits are paid from our general assets to supplement Retirement

Plan benefits and Social Security. Prior to 2008, executive, administrative and professional employees (other than those employed as

salespersons) with an annual base salary at least equal to a minimum established by the Company were eligible to participate. Similar

to the Retirement Plan, effective December 31, 2007, eligibility and benefit accruals under the SERP were frozen for all participants

except for those "Rule of 65" employees who elected to continue participating in the Retirement Plan. At normal retirement age (the

later of age 65 and the fifth anniversary of the participant's date of hire), an eligible participant with 25 or more years of service is

entitled to full benefits in the form of monthly payments under the SERP computed as a straight life annuity, equal to 50 percent of the

participant's average monthly compensation for the highest consecutive 60 months preceding retirement less 60 percent of his or her

estimated annual primary Social Security benefit, offset by the benefit accrued by the participant under the Retirement Plan. The

amount is then adjusted actuarially to determine the actual monthly payments based on the time and form of payment. For this

purpose, "compensation" includes salary but does not include bonuses. If the participant has fewer than 25 years of service, the

combined benefit is proportionately reduced. Benefits under the SERP become fully vested after five years of service with us. The

SERP is designed to comply with the requirements of Section 409A of the Code. Along with the Retirement Plan and the ESP, benefit

accruals under the SERP were frozen for the remaining "Rule of 65" employees effective August 1, 2010 and those remaining

participants were given the opportunity to participate in the DC SERP.

68