Neiman Marcus 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

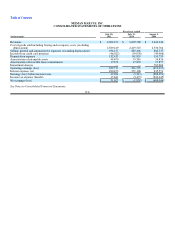

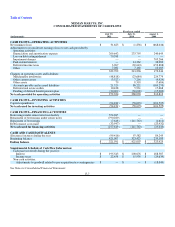

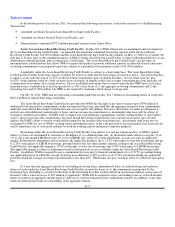

NEIMAN MARCUS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Fiscal year ended

(in thousands)

July 30,

2011

July 31,

2010

August 1,

2009

CASH FLOWS—OPERATING ACTIVITIES

Net earnings (loss) $ 31,623 $ (1,838) $ (668,046)

Adjustments to reconcile net earnings (loss) to net cash provided by

operating activities:

Depreciation and amortization expense 209,642 233,795 240,645

Loss on debt extinguishment 70,388 — —

Impairment charges — — 703,266

Paid-in-kind interest — 14,362 38,082

Deferred income taxes 3,967 (39,643) (153,888)

Other 7,082 7,160 10,185

322,702 213,836 170,244

Changes in operating assets and liabilities:

Merchandise inventories (48,818) (23,684) 224,779

Other current assets (3,527) 7,216 (9,924)

Other assets 79 8,518 (7,684)

Accounts payable and accrued liabilities 21,520 86,221 (169,270)

Deferred real estate credits 10,428 5,931 17,668

Funding of defined benefit pension plan (30,000)(30,000)(15,000)

Net cash provided by operating activities 272,384 268,038 210,813

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (94,181)(58,693)(101,525)

Net cash used for investing activities (94,181)(58,693)(101,525)

CASH FLOWS—FINANCING ACTIVITIES

Borrowings under senior term loan facility 554,265 — —

Repayment of borrowings under senior notes (790,289) — —

Repayment of borrowings (7,648) (111,763) (1,611)

Debt issuance costs paid (33,947)— (23,432)

Net cash used for financing activities (277,619)(111,763)(25,043)

CASH AND CASH EQUIVALENTS

(Decrease) increase during the year (99,416) 97,582 84,245

Beginning balance 421,007 323,425 239,180

Ending balance $ 321,591 $ 421,007 $ 323,425

Supplemental Schedule of Cash Flow Information:

Cash paid (received) during the year for:

Interest $ 195,543 $ 200,676 $ 188,587

Income taxes $ 22,458 $ 15,930 $ (29,639)

Non-cash activities:

Adjustments to goodwill related to pre-acquisition tax contingencies $ — $ — $ (18,049)

See Notes to Consolidated Financial Statements.

F-7