Neiman Marcus 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

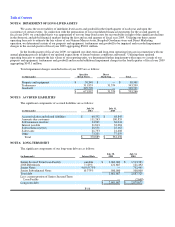

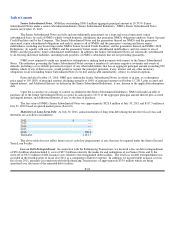

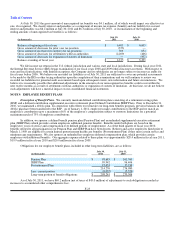

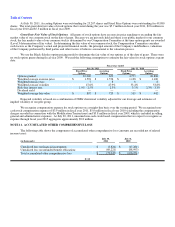

Interest expense. The significant components of interest expense are as follows:

Fiscal year ended

(in thousands)

July 30,

2011

July 31,

2010

August 1,

2009

Senior Secured Term Loan Facility $ 75,233 $ 83,468 $ 90,952

2028 Debentures 8,881 8,886 8,906

Senior Notes 53,916 68,315 66,356

Senior Subordinated Notes 51,732 51,732 52,028

Amortization of debt issue costs 14,661 18,697 17,185

Other, net 6,177 6,296 1,140

Capitalized interest (535)(286)(993)

$ 210,065 $ 237,108 $ 235,574

Loss on debt extinguishment 70,388 — —

Interest expense, net $ 280,453 $ 237,108 $ 235,574

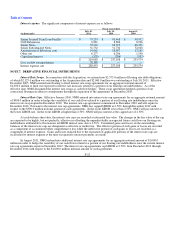

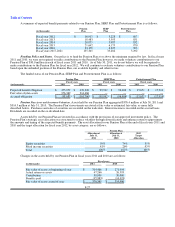

NOTE 7. DERIVATIVE FINANCIAL INSTRUMENTS

Interest Rate Swaps. In connection with the Acquisition, we entered into $2,575.0 million of floating rate debt obligations,

of which $2,125.0 million was outstanding at the Acquisition date and $2,060.0 million was outstanding at July 30, 2011. Effective

December 2005, NMG entered into floating to fixed interest rate swap agreements for an aggregate notional amount of

$1,000.0 million to limit our exposure to interest rate increases related to a portion of our floating rate indebtedness. As of the

effective date, NMG designated the interest rate swaps as cash flow hedges. These swap agreements hedged a portion of our

contractual floating rate interest commitments through the expiration of the agreements in December 2010.

Interest Rate Caps. Effective January 2010, NMG entered into interest rate cap agreements for an aggregate notional amount

of $500.0 million in order to hedge the variability of our cash flows related to a portion of our floating rate indebtedness once the

interest rate swap expired in December 2010. The interest rate cap agreements commenced in December 2010 and will expire in

December 2012. Pursuant to the interest rate cap agreements, NMG has capped LIBOR at 2.50% through December 2012 with

respect to the $500.0 million notional amount of such agreements. In the event LIBOR is less than 2.50%, NMG will pay interest at

the lower LIBOR rate. In the event LIBOR is higher than 2.50%, NMG will pay interest at the capped rate of 2.50%.

At each balance sheet date, the interest rate caps are recorded at estimated fair value. The changes in the fair value of the cap

are expected to be highly, but not perfectly, effective in offsetting the unpredictability in expected future cash flows on floating rate

indebtedness attributable to fluctuations in LIBOR interest rates above 2.50%. Unrealized gains and losses on the outstanding

balances of the interest rate caps are designated as effective or ineffective. The effective portion of such gains or losses are recorded

as a component of accumulated other comprehensive loss while the ineffective portion of such gains or losses are recorded as a

component of interest expense. Gains and losses realized due to the expiration of applicable portions of the interest rate caps are

reclassified to interest expense at the time our quarterly interest payments are made.

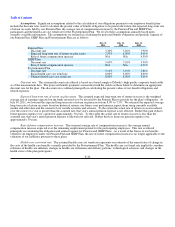

In August 2011, NMG entered into additional interest rate cap agreements for an aggregate notional amount of $1,000.0

million in order to hedge the variability of our cash flows related to a portion of our floating rate indebtedness once the current interest

rate cap agreements expire in December 2012. The interest rate cap agreements cap LIBOR at 2.50% from December 2012 through

December 2014 with respect to the $1,000.0 million notional amount of such agreements.

F-22