Neiman Marcus 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

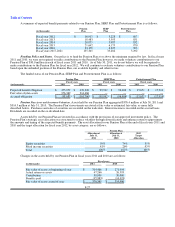

case, the internal rate of return to the Sponsors is positive. As of July 30, 2011, the vested participant balance in the Long-Term

Incentive Plan aggregated $7.3 million.

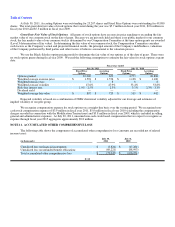

Cash Incentive Plan. We also have a cash incentive plan (Cash Incentive Plan) to aid in the retention of certain key

executives. The Cash Incentive Plan provides for the creation of a $14 million cash bonus pool. Each participant in the Cash

Incentive Plan will be entitled to a cash bonus upon the earlier to occur of a change of control, as defined, or an initial public offering,

as defined, subject to the requirement that, in each case, the internal rate of return to the Sponsors is positive.

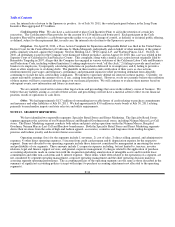

Litigation. On April 30, 2010, a Class Action Complaint for Injunction and Equitable Relief was filed in the United States

District Court for the Central District of California by Sheila Monjazeb, individually and on behalf of other members of the general

public similarly situated, against the Company, Newton Holding, LLC, TPG Capital, L.P. and Warburg Pincus, LLC. On July 12,

2010, all defendants except for the Company were dismissed without prejudice, and on August 20, 2010, this case was refiled in the

Superior Court of California for San Francisco County. This complaint, along with a similar class action lawsuit originally filed by

Bernadette Tanguilig in 2007, alleges that the Company has engaged in various violations of the California Labor Code and Business

and Professions Code, including without limitation 1) asking employees to work "off the clock," 2) failing to provide meal and rest

breaks to its employees, 3) improperly calculating deductions on paychecks delivered to its employees, and 4) failing to provide a

chair or allow employees to sit during shifts. The plaintiffs in these matters seek certification of their cases as class actions,

reimbursement for past wages and temporary, preliminary and permanent injunctive relief preventing defendant from allegedly

continuing to violate the laws cited in their complaints. We intend to vigorously defend our interests in these matters. Currently, we

cannot reasonably estimate the amount of loss, if any, arising from these matters. However, we do not currently believe the resolution

of these matters will have a material adverse impact on our financial position. We will continue to evaluate these matters based on

subsequent events, new information and future circumstances.

We are currently involved in various other legal actions and proceedings that arose in the ordinary course of business. We

believe that any liability arising as a result of these actions and proceedings will not have a material adverse effect on our financial

position, results of operations or cash flows.

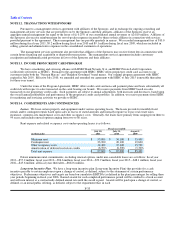

Other. We had approximately $13.7 million of outstanding irrevocable letters of credit relating to purchase commitments

and insurance and other liabilities at July 30, 2011. We had approximately $3.0 million in surety bonds at July 30, 2011 relating

primarily to merchandise imports and state sales tax and utility requirements.

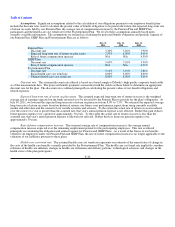

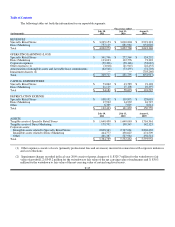

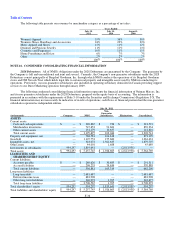

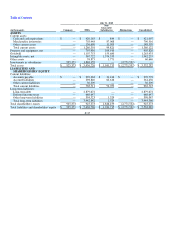

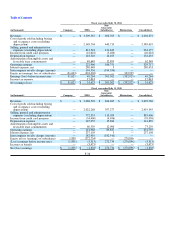

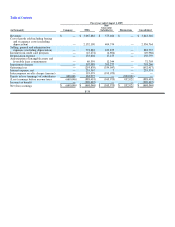

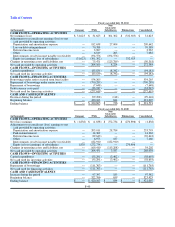

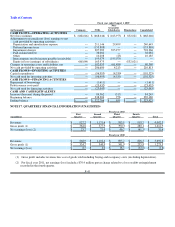

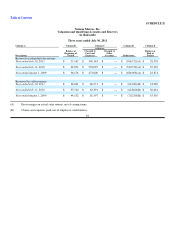

NOTE 15. SEGMENT REPORTING

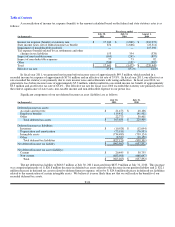

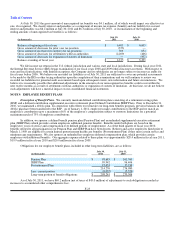

We have identified two reportable segments: Specialty Retail Stores and Direct Marketing. The Specialty Retail Stores

segment aggregates the activities of our Neiman Marcus and Bergdorf Goodman retail stores, including Neiman Marcus Last Call

stores. The Direct Marketing segment conducts both online and print catalog operations under the Neiman Marcus, Bergdorf

Goodman, Neiman Marcus Last Call and Horchow brand names. Both the Specialty Retail Stores and Direct Marketing segments

derive their revenues from the sales of high-end fashion apparel, accessories, cosmetics and fragrances from leading designers,

precious and fashion jewelry and decorative home accessories.

Operating earnings (loss) for the segments include 1) revenues, 2) cost of sales, 3) direct selling, general, and administrative

expenses, 4) other direct operating expenses, 5) income from credit card program and 6) depreciation expense for the respective

segment. Items not allocated to our operating segments include those items not considered by management in measuring the assets

and profitability of our segments. These amounts include 1) corporate expenses including, but not limited to, treasury, investor

relations, legal and finance support services, and general corporate management, 2) charges related to the application of purchase

accounting adjustments made in connection with the Acquisition including amortization of intangible assets and favorable lease

commitments and other non-cash items and 3) interest expense. These items, while often related to the operations of a segment, are

not considered by segment operating management, corporate operating management and the chief operating decision maker in

assessing segment operating performance. The accounting policies of the operating segments are the same as those described in the

summary of significant accounting policies (except with respect to purchase accounting adjustments not allocated to the operating

segments).

F-34