Neiman Marcus 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

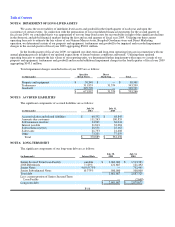

Table of Contents

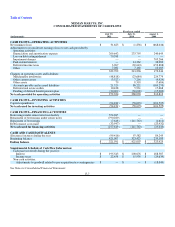

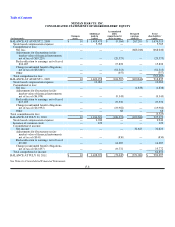

NEIMAN MARCUS, INC.

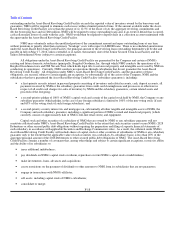

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(in thousands)

Common

stock

Additional

paid-in

capital

Accumulated

other

comprehensive

(loss) income

Retained

earnings

(deficit)

Total

shareholders'

equity

BALANCE AT AUGUST 2, 2008 $ 10 $ 1,418,473 $ (9,164) $ 267,200 $ 1,676,519

Stock based compensation expense — 5,785 — — 5,785

Comprehensive loss:

Net loss — — — (668,046) (668,046)

Adjustments for fluctuations in fair

market value of financial instruments,

net of tax of ($19,229) — — (29,575) — (29,575)

Reclassification to earnings, net of tax of

$10,287 — — 15,822 — 15,822

Change in unfunded benefit obligations,

net of tax of ($52,865) — — (81,313) — (81,313)

Other — — (357) — (357)

Total comprehensive loss (763,469)

BALANCE AT AUGUST 1, 2009 10 1,424,258 (104,587)(400,846)918,835

Stock based compensation expense — 10,063 — — 10,063

Comprehensive loss:

Net loss — — — (1,838) (1,838)

Adjustments for fluctuations in fair

market value of financial instruments,

net of tax of ($6,074) — — (9,343) — (9,343)

Reclassification to earnings, net of tax of

$17,925 — — 27,570 — 27,570

Change in unfunded benefit obligations,

net of tax of ($12,992) — — (19,982) — (19,982)

Other — — 68 — 68

Total comprehensive loss (3,525)

BALANCE AT JULY 31, 2010 10 1,434,321 (106,274)(402,684)925,373

Stock based compensation expense — 3,943 — — 3,943

Issuance of common stock — 129 — — 129

Comprehensive income:

Net income — — — 31,623 31,623

Adjustments for fluctuations in fair

market value of financial instruments,

net of tax of ($541) — — (830) — (830)

Reclassification to earnings, net of tax of

$9,289 — — 14,287 — 14,287

Change in unfunded benefit obligations,

net of tax of ($12,857) — — 19,772 — 19,772

Total comprehensive income 64,852

BALANCE AT JULY 30, 2011 $ 10 $ 1,438,393 $ (73,045)$ (371,061)$ 994,297

See Notes to Consolidated Financial Statements.

F-8