Neiman Marcus 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

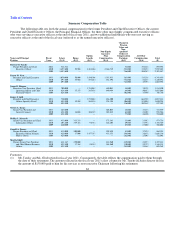

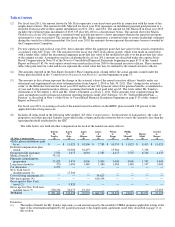

Individual Compensation Components

Base Salary. Base salary is intended to provide a base level of compensation commensurate with an executive's job title,

role, tenure, and experience. We utilize base salary as a building block of our compensation program, establishing a salary range for

particular positions based on survey data and job responsibilities. Being competitive in base salary is a minimum requirement to

recruit and retain skilled executives. Specifically, base salary levels of the named executive officers are determined based on a

combination of factors, including our compensation philosophy, market compensation data, competition for key executive talent, the

named executive officer's experience, leadership, achievement of specified business objectives, individual performance, our overall

budget for merit increases, and attainment of our financial goals. Salaries are reviewed before the end of each fiscal year as part of our

performance and compensation review process as well as at other times to recognize a promotion or change in job responsibilities.

Merit increases are usually awarded to the named executive officers in the same percentage range as all employees and are based on

overall performance and competitive market data except in those situations where individual performance and other factors justify

awarding increases above or below this range. Merit increases typically range between two and eight percent.

In addition, Ms. Katz and Messrs. Skinner and Gold have employment agreements, described in more detail beginning on

page 71, that set a minimum salary upon execution of the agreement.

Annual Incentive Bonus. Annual bonus incentives keyed to short-term objectives form the second building block of our

compensation program and are designed to provide incentives to achieve certain financial goals of the Company and individual

performance objectives. Financial goals, which are used to determine annual bonus incentives for all employees, emphasize

profitability and asset management. The Compensation Committee believes that a significant portion of annual cash compensation for

the named executive officers should be at risk and tied to our operational and financial results. "Pay for performance" for the named

executive officers has been significantly enhanced in recent years by putting a larger percentage of their potential compensation at risk

as part of the annual bonus incentive program.

All named executive officers are eligible to be considered for annual bonus incentives. Threshold, target, and maximum

annual performance incentives, stated as a percentage of base salary, are established for each of the named executive officers at the

beginning of each fiscal year. The objectives set for Ms. Katz and other senior officers with broad corporate responsibilities are based

on our overall financial results as well as individual performance objectives. When an employee has responsibility for a particular

business unit or division, the performance goals are heavily weighted toward the operational performance of that unit or division.

Actual awards earned by the named executive officers are determined based on an assessment of our overall performance, a review of

each named executive officer's contribution to our overall performance, and an assessment of the individual performance by each

named executive officer. Other components may also be considered from time to time at the discretion of the Compensation

Committee.

The employment agreements of Ms. Katz and Messrs. Skinner and Gold contain provisions regarding target levels and the

payment of annual incentives and are described in more detail beginning on page 71.

Long-Term Incentives. Long-term incentives in the form of stock options are intended to promote sustained high

performance and to align our executives' interests with those of our equity investors. The Compensation Committee believes that

stock options create value for the executives if the value of the Company increases. This creates a direct correlation between the

interests of our executives and the interests of our equity investors.

Equity awards become effective on the date of grant, which typically coincides with the date of approval by the

Compensation Committee or the date of a new hire or a promotion.

An initial stock option grant was made in fiscal year 2006 under the Neiman Marcus, Inc. Management Equity Incentive Plan

(referred to as the Management Incentive Plan) to all eligible officers, including the named executive officers. The initial stock option

grants were not tied to performance objectives and were made following the consummation of the Acquisition in order to retain the

senior management team and enable them to share in the growth of the Company along with our equity investors. The initial stock

option grants were awarded at an exercise price equal to the fair market value of our common stock at the time of the grant. The

exercise prices of certain of our options, which represent approximately one-third of all outstanding options, escalate at a 10%

compound rate per year (Accreting Options) until the earlier of (i) exercise, (ii) a defined anniversary of the date of grant (four to five

years) or (iii) the occurrence of a change of control. However, in the event the Sponsors cause the sale of shares of the Company to an

unaffiliated entity, the exercise price will cease to accrete at the time of the sale with respect to a pro rata portion of the Accreting

Options. The exercise price with respect to all other options (Fixed Price Options) is fixed at the grant date.

54