Neiman Marcus 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

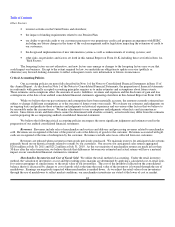

The areas requiring significant management judgment related to the valuation of our inventories include 1) setting the

original retail value for the merchandise held for sale, 2) recognizing merchandise for which the customer's perception of value has

declined and appropriately marking the retail value of the merchandise down to the perceived value and 3) estimating the shrinkage

that has occurred between physical inventory counts. These judgments and estimates, coupled with the averaging processes within the

retail method can, under certain circumstances, produce varying financial results. Factors that can lead to different financial results

include 1) determination of original retail values for merchandise held for sale, 2) identification of declines in perceived value of

inventories and processing the appropriate retail value markdowns and 3) overly optimistic or conservative estimation of shrinkage.

In prior years, we have not made material changes to our estimates of shrinkage or markdown requirements on inventories held as of

the end of our fiscal years. We do not believe that changes in the assumptions and estimates, if any, used in the valuation of our

inventories at July 30, 2011 will have a material effect on our future operating performance.

Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise

we purchase for resale. Certain allowances are received to reimburse us for markdowns taken or to support the gross margins that we

earn in connection with the sales of the vendor's merchandise. These allowances result in an increase to gross margin when we earn

the allowances and they are approved by the vendor. Other allowances we receive represent reductions to the amounts we pay to

acquire the merchandise. These allowances reduce the cost of the acquired merchandise and are recognized at the time the goods are

sold. The amounts of vendor allowances we receive fluctuate based on the level of markdowns taken and did not have a significant

impact on the year-over-year change in gross margin during fiscal years 2011, 2010 or 2009. We received vendor allowances of

$87.5 million, or 2.2% of revenues, in fiscal year 2011, $81.2 million, or 2.2% of revenues, in fiscal year 2010 and $107.7 million, or

3.0% of revenues, in fiscal year 2009.

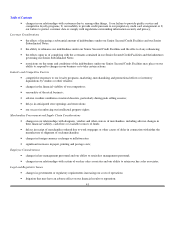

Long-lived Assets. Property and equipment are stated at cost less accumulated depreciation. For financial reporting

purposes, we compute depreciation principally using the straight-line method over the estimated useful lives of the assets. Buildings

and improvements are depreciated over five to 30 years while fixtures and equipment are depreciated over three to 15 years.

Leasehold improvements are amortized over the shorter of the asset life or the lease term (which may include renewal periods when

exercise of the renewal option is at our discretion and exercise of the renewal option is considered reasonably assured). Costs incurred

for the development of internal computer software are capitalized and amortized using the straight-line method over three to ten years.

To the extent we remodel or otherwise replace or dispose of property and equipment prior to the end of the assigned

depreciable lives, we could realize a loss or gain on the disposition. To the extent assets continue to be used beyond their assigned

depreciable lives, no depreciation expense is incurred. We reassess the depreciable lives of our long-lived assets in an effort to reduce

the risk of significant losses or gains at disposition and the utilization of assets with no depreciation charges. The reassessment of

depreciable lives involves utilizing historical remodel and disposition activity and forward-looking capital expenditure plans.

We assess the recoverability of the carrying values of our store assets, consisting of property and equipment, customer lists

and favorable lease commitments, annually and upon the occurrence of certain events. The recoverability assessment requires

judgment and estimates of future store generated cash flows. The underlying estimates of cash flows include estimates for future

revenues, gross margin rates and store expenses. We base these estimates upon the stores' past and expected future performance. New

stores may require two to five years to develop a customer base necessary to generate the cash flows of our more mature stores. To

the extent our estimates for revenue growth and gross margin improvement are not realized, future annual assessments could result in

impairment charges.

Indefinite-Lived Intangible Assets and Goodwill. Indefinite-lived intangible assets, such as tradenames and goodwill, are

not subject to amortization. Rather, we assess the recoverability of indefinite-lived intangible assets and goodwill in the fourth quarter

of each fiscal year and upon the occurrence of certain events.

The recoverability assessment with respect to each of the tradenames used in our operations requires us to estimate the fair

value of the tradename as of the assessment date. Such determination is made using discounted cash flow techniques (Level 3).

Inputs to the valuation model include:

• future revenue and profitability projections associated with the tradename;

• estimated market royalty rates that could be derived from the licensing of our tradenames to third parties in order to

establish the cash flows accruing to the benefit of the Company as a result of our ownership of our tradenames; and

43