Neiman Marcus 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185

|

|

Table of Contents

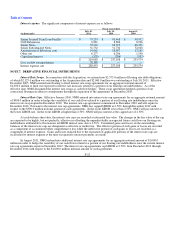

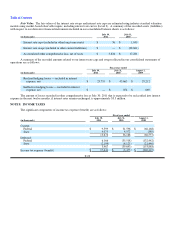

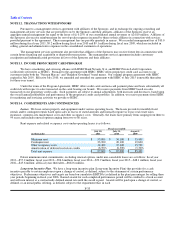

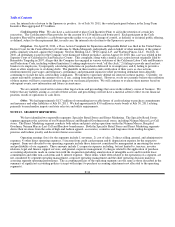

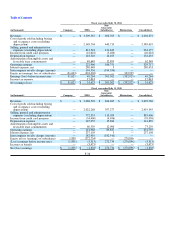

The following tables sets forth by level, within the fair value hierarchy, the Pension Plan's assets at fair value as of July 30,

2011 and July 31, 2010.

Fiscal year 2011

(in thousands) Level 1 Level 2 Level 3 Total

Cash and cash equivalents $ 816 $ — $ — $ 816

Equity securities:

Corporate stock 6,068 — — 6,068

Mutual funds 11,284 — — 11,284

Common/collective trusts — 39,698 — 39,698

Hedge funds — — 141,810 141,810

Limited partnership interests — — 21,409 21,409

Fixed income securities:

Corporate debt securities — 33,951 — 33,951

Mutual funds 110,795 — — 110,795

U.S. government securities 7,038 — — 7,038

Other — 3,500 — 3,500

Total investments $ 136,001 $ 77,149 $ 163,219 $ 376,369

Fiscal year 2010

(in thousands) Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stock $ 20,114 $ — $ — $ 20,114

Mutual funds 42,694 — — 42,694

Common/collective trusts — 44,686 — 44,686

Hedge funds — — 108,785 108,785

Limited partnership interests — — 15,359 15,359

Fixed income securities:

Corporate debt securities — 30,930 — 30,930

Mutual funds 40,245 — — 40,245

U.S. government securities 6,481 1,598 — 8,079

Other — 3,574 — 3,574

Total investments $ 109,534 $ 80,788 $ 124,144 $ 314,466

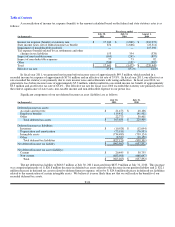

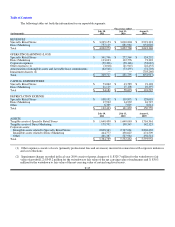

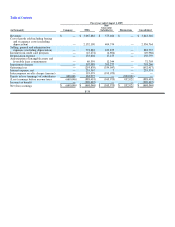

The table below sets forth a summary of changes in the fair value of our Pension Plan's Level 3 investment assets for the

fiscal years 2011 and 2010.

Fiscal years

(in thousands) 2011 2010

Balance, beginning of year $ 124,144 $ 87,448

Purchases 40,367 35,946

Sales (21,590) (6,610)

Realized gains 201 239

Unrealized gains relating to investments still held 20,097 7,121

Balance, end of year $ 163,219 $ 124,144

F-29