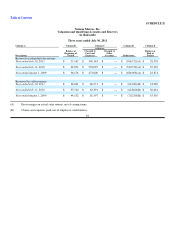

Neiman Marcus 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ARTICLE ONE

DEFINITIONS

Section 1.01 Defined Terms. All capitalized terms used but not defined herein shall have the meanings ascribed to such

terms in the Original Indenture, as supplemented and amended hereby. All definitions in the Original Indenture shall be read in a

manner consistent with the terms of this First Supplemental Indenture.

ARTICLE TWO

GUARANTEE

Pursuant to Section 901 of the Base Indenture, the Company and the Trustee hereby provide and the Guarantor hereby agrees

as follows:

Section 2.01 The Guarantee. The Guarantor hereby irrevocably and unconditionally guarantees (the "Guarantee"), as

primary obligor and not merely as surety, the 2028 Debentures and obligations of the Company under the Indenture and the 2028

Debentures, and guarantees to each Holder of a 2028 Debenture authenticated and delivered by the Trustee, and to the Trustee for

itself and on behalf of such Holder, that: (1) the principal of (and premium, if any) and interest on the 2028 Debentures shall be paid in

full when due, whether at Stated Maturity, by acceleration or otherwise (including the amount that would become due but for the

operation of the automatic stay under Section 362(a) of Title 11 of the United States Bankruptcy Code of 1978, as amended (the

"Bankruptcy Law")) together with interest on the overdue principal, if any, and interest on any overdue interest, to the extent lawful,

and all other obligations of the Company to the Holders or the Trustee hereunder or thereunder shall be paid in full or performed, all in

accordance with the terms hereof and thereof; and (2) in case of any extension of time of payment or renewal of any 2028 Debentures

or of any such other obligations, the same shall be paid in full when due or performed in accordance with the terms of the extension or

renewal, whether at Stated Maturity, by acceleration or otherwise.

(a) The Guarantor hereby agrees that its obligations hereunder shall be unconditional, irrespective of the

validity, regularity or enforceability of the 2028 Debentures or the Indenture, the absence of any action to enforce the same, any

waiver or consent by any Holder with respect to any provisions hereof or thereof, the recovery of any judgment against the Company,

any action to enforce the same or any other circumstance which might otherwise constitute a legal or equitable discharge or defense of

the Guarantor.

(b) The Guarantor hereby waives (to the extent permitted by law) the benefits of diligence, presentment,

demand for payment, filing of claims with a court in the event of insolvency or bankruptcy of the Company, any right to require a

proceeding first against the Company or any other Person, protest, notice and all demands whatsoever and covenants that the

Guarantee shall not be discharged as to any 2028 Debenture except by complete performance of the obligations contained in such

2028 Debenture, the Indenture and the Guarantee. The

2