National Grid 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 81

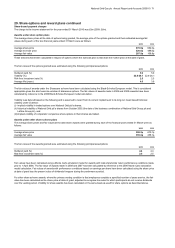

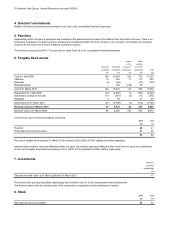

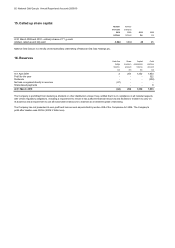

14. Provisions for liabilities and charges

Deferred

Environmental Emissions Restructuring taxation Other Total

£m £m £m £m £m £m

A

t 1 April 2009 56 2 43 808 48 957

Charged to profit and loss account 14 4 28 27 11 84

Transferred to reserves - - - (18) - (18)

Utilised (2) - (25) - (10) (37)

Released ----(2)(2)

Unwinding of discoun

t

2----2

At 31 March 2010 70 6 46 817 47 986

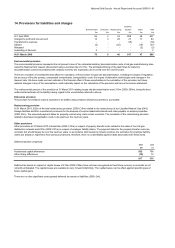

Environmental provision

Emissions provision

Restructuring provision

Other provisions

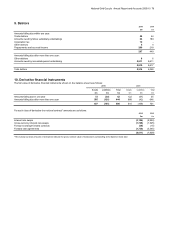

Deferred taxation comprises:

2010 2009

£m £m

A

ccelerated capital allowances 832 796

Other timing differences (15) 12

817 808

There are no other significant unrecognised deferred tax assets or liabilities (2009: £nil).

Deferred tax assets in respect of capital losses of £15m (2009: £24m) have not been recognised as their future recovery is uncertain or not

currently anticipated. The capital losses are available to carry forward indefinitely. The capital losses can be offset against specific types of

future capital gains.

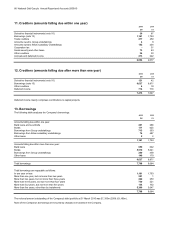

The undiscounted amount of the provision at 31 March 2010 relating to gas site decontamination was £110m (2009: £85m), being the best

undiscounted estimate of the liability having regard to the uncertainties referred to above.

Other provisions at 31 March 2010 include £6m (2009: £12m) in respect of property transfer costs related to the sales of four UK gas

distribution networks and £21m (2009: £21m) in respect of employer liability claims. The payment dates for the property transfer costs are

uncertain but should largely be over the next two years. In accordance with insurance industry practice, the estimates for employer liability

claims are based on experience from previous years and, therefore, there is no identifiable payment date associated with these items.

At 31 March 2010, £26m of the total restructuring provision (2009: £19m) related to the restructuring of our Liquefied Natural Gas (LNG)

storage facilities and £5m consisted of provisions for the disposal of surplus leasehold interests and rates payable on surplus properties

(2009: £5m). The expected payment dates for property restructuring costs remain uncertain. The remainder of the restructuring provision

related to business reorganisation costs, to be paid over the next two years.

There are a number of uncertainties that affect the calculation of the provision for gas site decontamination, including the impact of regulation,

the accuracy of the site surveys, unexpected contaminants, transportation costs, the impact of alternative technologies and changes in the

discount rate. We have made our best estimate of the financial effect of these uncertainties in the calculation of the provision, but future

material changes in any of the assumptions could materially impact on the calculation of the provision and hence the income statement.

The provision for emission costs is expected to be settled using emission allowances granted or purchased.

The environmental provision represents the net present value of the estimated statutory decontamination costs of old gas manufacturing sites

owned by National Grid Gas plc (discounted using a nominal rate of 2.0%). The anticipated timing of the cash flows for statutory

decontamination cannot be predicted with certainty, but they are expected to be incurred over the next 50 years.