National Grid 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Grid Gas plc Annual Report and Accounts 2009/10 63

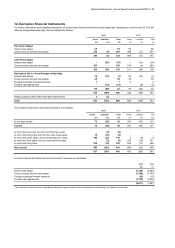

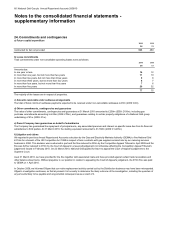

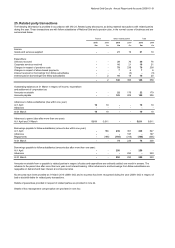

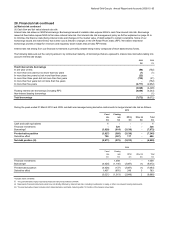

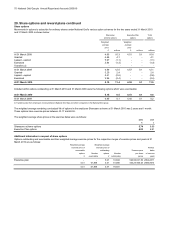

27. Supplementary information on derivative financial instruments

Treasury financial instruments

Fair value hedges

Cash flow hedges

Derivatives not in a formal hedge relationship

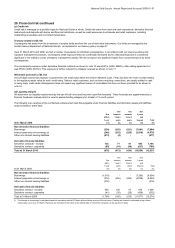

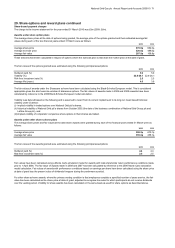

Fair value hedges principally consist of interest rate and cross-currency swaps that are used to protect against changes in the fair value of

fixed-rate, long-term financial instruments due to movements in market interest rates. For qualifying fair value hedges, all changes in the fair

value of the derivative and changes in the fair value of the item in relation to the risk being hedged are recognised in the income statement. If

the hedge relationship is terminated, the fair value adjustment to the hedged item continues to be reported as part of the basis of the item and

is amortised to the income statement as a yield adjustment over the remainder of the life of the hedged item.

The gains and losses on ineffective portions of such derivatives are recognised immediately in remeasurements within the income statement.

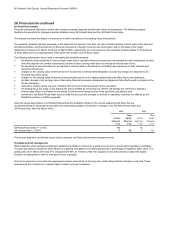

Our policy is not to use derivatives for trading purposes. However, due to the complex nature of hedge accounting under IAS 39 some

derivatives may not qualify for hedge accounting, or are specifically not designated as a hedge where natural offset is more appropriate.

Changes in the fair value of any derivative instruments that do not qualify for hedge accounting are recognised immediately in

remeasurements within the income statement.

Hedging policies using derivative financial instruments are further explained in note 28. Derivatives that are held as hedging instruments are

formally designated as hedges as defined in IAS 39. Derivatives may qualify as hedges for accounting purposes if they are fair value hedges

or cash flow hedges. These are described as follows:

When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, any cumulative gain or loss

existing in equity at that time remains in equity and is recognised when the forecast transaction is ultimately recognised in the income

statement or on the balance sheet. When a forecast transaction is no longer expected to occur, the cumulative gain or loss that was reported

in equity is immediately transferred to remeasurements within the income statement.

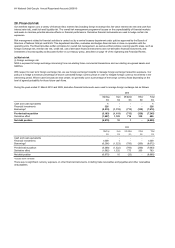

Exposure arises from the variability in future interest and currency cash flows on assets and liabilities which bear interest at variable rates or

are in a foreign currency. Interest rate and cross-currency swaps are maintained, and designated as cash flow hedges where they qualify, to

manage this exposure. Fair value changes on designated cash flow hedges are initially recognised directly in the cash flow hedge reserve, as

gains or losses recognised in equity. Amounts are transferred from equity and recognised in the income statement as the income or expense

is recognised on the hedged asset or liability.

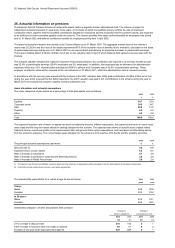

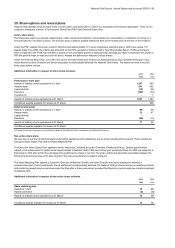

Derivatives are financial instruments that derive their value from the price of an underlying item such as interest rates, foreign exchange,

credit spreads, or other indices. Derivatives enable their users to alter exposure to market or credit risks. We use derivatives to manage our

treasury risks.

Forward foreign currency contracts are used to hedge anticipated and committed future currency cash flows. Where these contracts qualify

for hedge accounting, they are designated as cash flow hedges. On recognition of the underlying transaction in the financial statements, the

associated hedge gains and losses deferred in equity are transferred and included with the recognition of the underlying transaction.

Derivatives are used for hedging purposes in the management of exposure to market risks. This enables the optimisation of the overall cost of

accessing debt capital markets, and mitigates the market risk which would otherwise arise from the maturity and other profiles of its assets

and liabilities.