National Grid 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26 National Grid Gas plc Annual Report and Accounts 2009/10

stated policy under which the company is charged for the costs

of providing pensions.

A change in these arrangements may lead to the company

recognising the cost of providing pensions on a different basis,

together with a proportion of the actuarial gains and losses and

of the assets and liabilities of the pension scheme.

Exceptional items and remeasurements

Exceptional items and remeasurements are items of income

and expenditure that, in the judgement of management, should

be disclosed separately on the basis that they are material,

either by their nature or their size, to an understanding of the

company’s financial performance and distort the comparability

of financial performance between periods.

Items of income or expense that are considered by

management for designation as exceptional items include such

items as significant restructurings, write-downs or impairments

of non-current assets, material changes in environmental

provisions, gains or losses on disposals of businesses or

investments.

Remeasurements comprise gains or losses recorded in the

income statement arising from changes in the fair value of

derivative financial instruments. These fair values increase or

decrease as a consequence of changes in financial indices and

prices over which the company has no control.

Provisions

Provisions are made for liabilities, the timing and amount of

which is uncertain. These include provisions for the cost of

environmental restoration and remediation, restructuring and

employer and public liability claims.

Calculations of these provisions are based on estimated cash

flows relating to these costs, discounted at an appropriate rate

where the impact of discounting is material. The total costs and

timing of cash flows relating to environmental liabilities are

based on management estimates supported by the use of

external consultants.

Tax estimates

The tax charge is based on the profit for the year and tax rates

in effect. Current tax assets and liabilities arising from transfer

pricing adjustments, which are expected to be fully recovered

through group relief, are recognised where material. Further

adjustments are recognised when tax returns are submitted to

the tax authorities. The determination of appropriate provisions

for taxation requires us to take into account anticipated

decisions of tax authorities and estimate its ability to utilise tax

benefits through future earnings and tax planning.

In order to illustrate the impact that changes in assumptions

could have on our results and financial position, the following

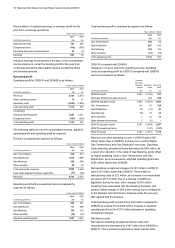

sensitivities are presented:

Revenue accruals

A 10% change in our estimate of unbilled revenues at 31 March

2010 would result in an increase or decrease in our recorded

net assets and profit for the year by approximately £13 million

net of tax.

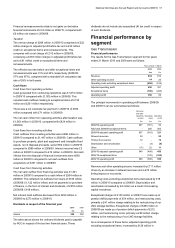

Asset useful lives

An increase in the useful economic lives of assets of one year

on average would reduce our annual depreciation charge on

property, plant and equipment by £14 million (pre-tax) and our

annual amortisation charge on intangible assets by £2 million

(pre-tax).

Hedge accounting

If using our derivative financial instruments, hedge accounting

had not been achieved during the year ended 31 March 2010

then the profit for the year would have been £131 million lower

than that reported net of tax, and net assets would have been

£79 million lower.

Assets carried at fair value

A 10% change in assets and liabilities carried at fair value

would result in an increase or decrease in the carrying value of

derivative financial instruments of £49 million.

Provisions

A 10% change in the estimates of future cash flows estimated

in respect of provisions for liabilities would result in an increase

or decrease in our provisions of approximately £17 million.

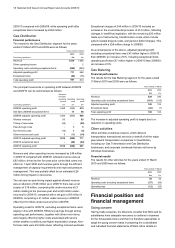

Accounting developments

Accounting standards, amendments to standards and

interpretations adopted in 2009/10

In preparing our consolidated financial statements we have

complied with International Financial Reporting Standards,

International Accounting Standards and interpretations

applicable for 2009/10. The standards, amendments to

standards and interpretations adopted during 2009/10 are

discussed in the financial statements on page 36. None of

these resulted in a material change to our consolidated results,

assets or liabilities in 2009/10 or in those of previous periods.

Accounting standards, amendments to standards and

interpretations not yet adopted

New accounting standards, amendments to standards and

interpretations which have been issued but not yet adopted by

National Grid are discussed in the financial statements on page

37.