National Grid 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 National Grid Gas plc Annual Report and Accounts 2009/10

Both short-term and long-term cash flow forecasts are produced

regularly to assist the treasury function in identifying short-term

liquidity and long-term funding requirements,and we seek to

enhance our cash flow forecasting processes on an ongoing

basis. Cash flow forecasts, supplemented by a financial

headroom analysis, are monitored regularly to assess funding

adequacy for at least a 12 month period.

As part of our regulatory arrangements, our operations are

subject to a number of restrictions on the way we can operate.

These include regulatory ‘ring fences’ that requires us to

maintain adequate financial resources and restricts our ability to

undertake transactions between certain National Grid

subsidiary companies including paying dividends, lending cash

or levy charges.

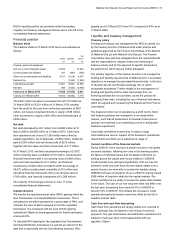

Funding and liquidity management

We maintain medium-term note and commercial paper

programmes to facilitate long and short-term debt issuance into

capital and money markets.

At 31 March 2010, NGG had a $2.5 billion US commercial

paper programme (unutilised), a $1.25 billion Euro commercial

paper programme (unutilised) and a €10.0 billion Euro medium-

term note programme (€5.7 billion issued).

In addition we have both committed and uncommitted bank

borrowing facilities that are available for general corporate

purposes to support our liquidity requirements. At 31 March

2010, the Company had £700 million of long-term committed

facilities (undrawn). Subsequent to year end these facilities

were renewed at a reduced level and now stand at £425 million,

expiring in April 2014.

We invest surplus funds on the money markets, usually in the

form of short-term fixed deposits and placements with money

market funds that are invested in highly liquid instruments of

high credit quality. Investment of surplus funds is subject to our

counterparty risk management policy, and we continue to

believe that our cash management and counterparty risk

management policies provide appropriate liquidity and credit

risk management. Details relating to cash, short-term

investments and other financial assets at 31 March 2010 are

shown in notes 15 and 16 to the consolidated financial

statements.

We believe that maturing amounts in respect of contractual

obligations as shown in commitments and contingencies in note

24 to the consolidated financial statements can be met from

existing cash and investments, operating cash flows and other

financings that we reasonably expect to be able to secure in the

future, together with the use of committed facilities if required.

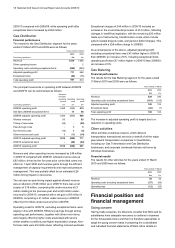

Credit ratings

It is a condition of the regulatory ring-fence around the

Company that it uses reasonable endeavours to maintain an

investment grade credit rating. As of 31 March 2010, the long-

term senior unsecured debt and short-term debt credit ratings

respectively provided by Moody’s Investor Services, Standard &

Poor’s and Fitch were as follows (all with outlooks of stable):

Moody’s Investor Services A3/P2

Standard & Poor’s A-/A2

Fitch A/F2

Use of derivative financial instruments

As part of our business operations, including our treasury

activities, we are exposed to risks arising from fluctuations in

interest rates and exchange rates. We use financial

instruments, including financial derivatives, to manage

exposures of this type. Our policy is not to use financial

derivatives for trading purposes. More details on derivative

financial instruments are provided in note 12 to the consolidated

financial statements.

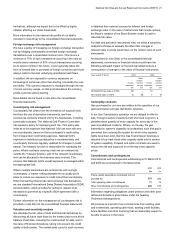

Refinancing risk management

Refinancing risk within National Grid is controlled mainly by

limiting the amount of debt maturities arising on borrowings in

any financial year.

Note 17 to the consolidated financial statements sets out the

contractual maturities of our borrowings over the next five

years, with total contracted borrowings maturing over 42 years.

We expect to be able to refinance this debt through the capital

and money markets as we have done during the year to 31

March 2010.

Interest rate risk management

Our interest rate exposure arising from borrowings and deposits

is managed by the use of fixed and floating rate debt and

derivative financial instruments, including interest rate swaps,

swaptions and forward rate agreements. The interest rate risk

management policy followed by National Grid is to seek to

minimise total financing costs (being interest costs and changes

in the market value of debt) subject to constraints so that, even

with an extreme movement in interest rates, neither the interest

cost nor the total financing cost is expected to exceed preset

limits with a high degree of certainty.

Some of NGG’s bonds in issue are inflation-linked, that is their

cost is linked to changes in the UK Retail Prices Index (RPI).

We believe that these bonds provide an appropriate hedge for

revenues and our regulatory asset values that are also RPI

linked under our price control formulas.

The performance of the treasury function in interest rate risk

management is measured by comparing the actual total

financing costs of the National Grid debt with those of a

passively managed benchmark portfolio with set ratios of fixed

rate to floating-rate debt, to identify the impact of actively

managing National Grid’s interest rate risk. This is monitored

regularly by the Finance Committee of National Grid.

Within the constraints of our interest rate risk management

policy, and as approved by the Finance Committee, we actively

manage our interest rate exposure and therefore the interest

rate profile shown at 31 March 2010 will change over time.

In 2010/11, we expect the financing costs of National Grid to

continue to benefit from low short-term interest rates, some of

which have already been locked in using short-term interest rate