National Grid 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 National Grid Gas plc Annual Report and Accounts 2009/10

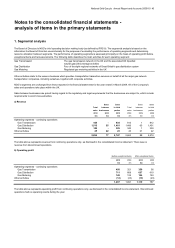

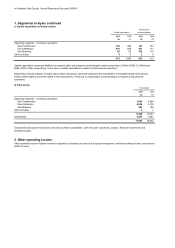

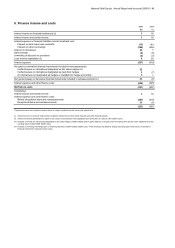

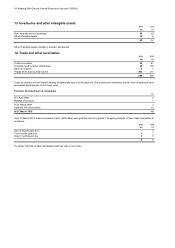

1. Segmental analysis continued

c) Capital expenditure and depreciation

Depreciation

Capital expenditure and amortisation

2010 2009 2010 2009

£m £m £m £m

Operating segments - continuing operations

Gas Transmission 232 389 127 123

Gas Distribution 670 598 201 177

Gas Metering 65 90 102 113

Other activities 5322

972 1,080 432 415

d) Total assets

Total assets

2010 2009

£m £m

Operating segments - continuing operations

Gas Transmission 3,990 3,866

Gas Distribution 6,592 6,139

Gas Metering 662 729

Other activities 47

11,248 10,741

Unallocated 6,597 7,691

17,845 18,432

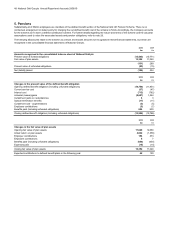

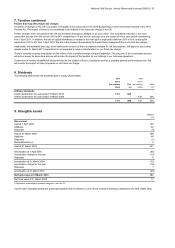

2. Other operating income

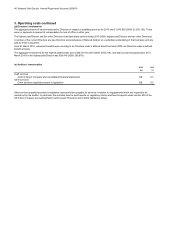

Capital expenditure comprises additions to property, plant and equipment and intangible assets amounting to £904m (2009: £1,048m) and

£68m (2009: £32m) respectively. There was no capital expenditure in respect of discontinued operations.

Depreciation and amortisation includes depreciation of property, plant and equipment and amortisation of intangible assets amounting to

£413m (2009: £400m) and £19m (2009: £15m) respectively. There was no depreciation and amortisation in respect of discontinued

operations.

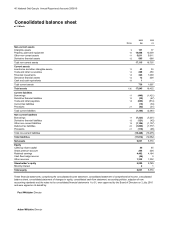

Unallocated total assets include amounts owed by fellow subsidiaries, cash and cash equivalents, taxation, financial investments and

derivative assets.

Other operating income includes income on disposal of properties as a result of property management, emissions trading income, and pension

deficit recovery.