National Grid 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

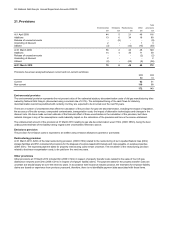

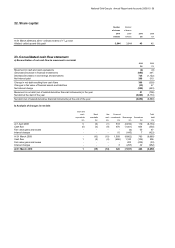

National Grid Gas plc Annual Report and Accounts 2009/10 49

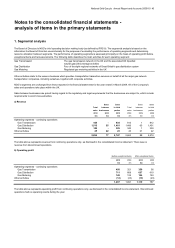

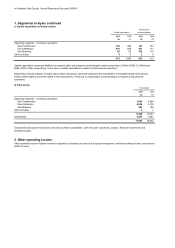

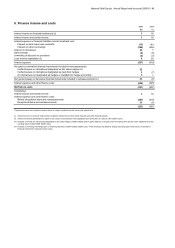

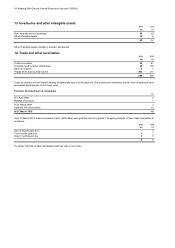

6. Finance income and costs

2010 2009*

£m £m

Interest income on financial instruments (i) 318

Interest income and similar income 318

Interest expense on financial liabilities held at amortised cost:

Interest on bank loans and overdrafts

(

13

)

(41)

Interest on other borrowings

(

284

)

(404)

Interest on derivatives 42 7

Other interest

(

8

)

(6)

Unwinding of discount on provisions

(

2

)

(3)

Less: interest capitalised (ii) 828

Interest expense

(

257

)

(419)

Net gains on derivative financial instruments included in remeasurements:

Ineffectiveness on derivatives designated as fair value hedges (iii) 25 -

Ineffectiveness on derivatives designated as cash flow hedges 3(7)

On derivatives not designated as hedges or ineligible for hedge accounting 51

Net gains/(losses) on derivative financial instruments included in remeasurements (iv) 33 (6)

Interest expense and other finance costs

(

224

)

(425)

Net finance costs

(

221

)

(407)

Comprising:

Interest income and similar income 318

Interest expense and other finance costs

Before exceptional items and remeasurements

(

257

)

(419)

Exceptional items and remeasurements 33 (6)

(

221

)

(407)

*Comparatives have been restated to present items on a basis consistent with the current year classification.

(i)

(ii)

(iii)

(iv)

Interest income on financial instruments comprises interest income from bank deposits and other financial assets.

Includes a net foreign exchange gain on financing activities of £84m (2009: £383m loss). These amounts are offset by foreign exchange gains and losses on derivative

financial instruments measured at fair value.

Includes a net loss on instruments designated as fair value hedges of £85m (2009: £245m gain) offset by a net gain of £110m arising from the fair value adjustments to the

carrying value of debt (2009: £245m loss).

Interest on funding attributable to assets in the course of construction was capitalised during the year at a rate of 3.6% (2009: 6.2%).