National Grid 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 59

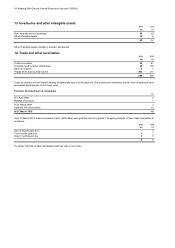

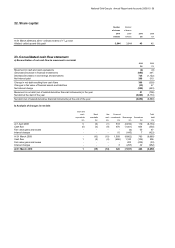

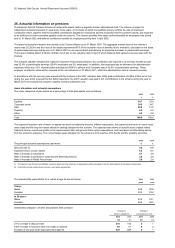

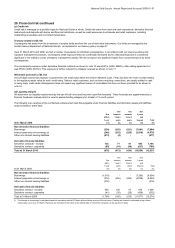

22. Share capital

Number Number

of shares of shares

2010 2009 2010 2009

millions millions £m £m

A

t 31 March 2009 and 2010 - ordinar

y

shares of 1

2

/

15

p each

3,944 3,944 45 45

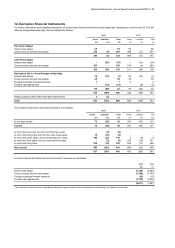

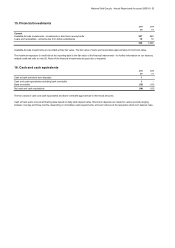

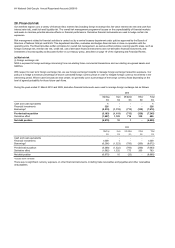

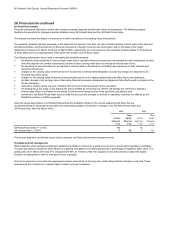

23. Consolidated cash flow statement

a) Reconciliation of net cash flow to movement in net deb

t

2010 2009

£m £m

Movement in cash and cash equivalents (4) (9)

(Decrease)/increase in financial investments (683) 491

Decrease/(increase) in borrowings and derivatives 725 (1,122)

Net interest paid 268 310

Change in net debt resulting from cash flows 306 (330)

Changes in fair value of financial assets and liabilities (33) 47

Net interest charge (252) (423)

Movement in net debt (net of related derivative financial instruments) in the year 21 (706)

Net debt at the start of the year (6,880) (6,174)

Net debt (net of related derivative financial instruments) at the end of the year (6,859) (6,880)

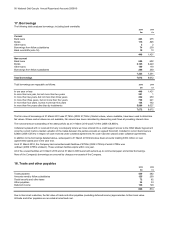

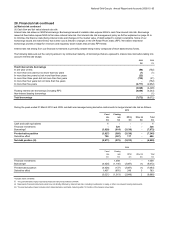

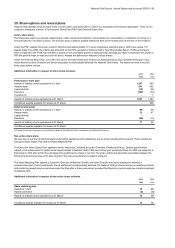

b) Analysis of changes in net deb

t

Cash and

cash Bank Net Financial Total

equivalents overdrafts cash investments Borrowings Derivatives debt

£m £m £m £m £m £m £m

A

t 1 April 2008 5 (6) (1) 518 (6,810) 119 (6,174)

Cash flo

w

(5) (4) (9) 476 (1,401) 604 (330)

Fair value gains and losses - - - - (6) 53 47

Interest charges - - - 15 (445) 7 (423)

A

t 31 March 2009 - (10) (10) 1,009 (8,662) 783 (6,880)

Cash flo

w

1 (5) (4) (686) 1,100 (104) 306

Fair value gains and losses - - - - 202 (235) (33)

Interest charges - - - 3 (297) 42 (252)

At 31 March 2010 1 (15) (14) 326 (7,657) 486 (6,859)

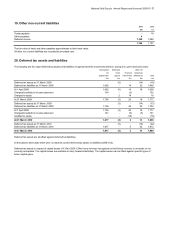

Allotted, called up and fully paid