National Grid 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34 National Grid Gas plc Annual Report and Accounts 2009/10

is discontinued, is amortised to the income statement using the

effective interest rate method.

If a hedged forecast transaction is no longer expected to occur,

the net cumulative gain or loss recognised in equity is

transferred to the income statement immediately.

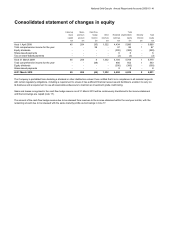

Q. Share-based payments

National Grid issues equity-settled share-based payments to

certain employees of the Company and its subsidiaries.

Equity-settled share-based payments are measured at fair

value at the date of grant based on an estimate of the number

of shares that will eventually vest. This fair value is recognised

on a straight-line basis over the vesting period, as an operating

cost and an increase in equity. Payments made by the

Company to National Grid in respect of share-based payments

are recognised as a reduction in equity.

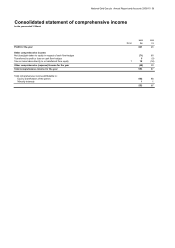

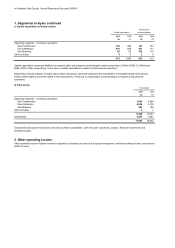

R. Business performance and exceptional items

and remeasurements

Our financial performance is analysed into two components:

business performance, which excludes exceptional items and

remeasurements; and exceptional items and remeasurements.

Business performance is used by management to monitor

financial performance, as it is considered to increase the

comparability of our reported financial performance from year to

year. Business performance subtotals, which exclude

exceptional items and remeasurements, are presented on the

face of the income statement or in the notes to the financial

statements.

Exceptional items and remeasurements are items of income

and expenditure that, in the judgment of management, should

be disclosed separately on the basis that they are material,

either by their nature or their size, to an understanding of our

financial performance and significantly distort the comparability

of financial performance between periods.

Items of income or expense that are considered by

management for designation as exceptional items include such

items as significant restructurings, write-downs, pension deficit

payments or impairments of non-current assets, significant

changes in environmental provisions, and gains or losses on

disposals of businesses or investments.

Costs arising from restructuring programmes primarily relate to

redundancy costs, impairment of assets, and site

decommissioning costs. Redundancy costs are charged to the

income statement in the year in which an irrevocable

commitment is made to incur the costs and the main features of

the restructuring plan have been announced to affected

employees.

Remeasurements comprise gains or losses recorded in the

income statement arising from changes in the fair value of

derivative financial instruments to the extent that hedge

accounting is not achieved or is not effective.

S. Other operating income

Other operating income primarily relates to profits or losses

arising on the disposal of properties arranged by National Grid’s

property management business, which is considered to be part

of normal recurring operating activities but which does not

represent revenue, income from the sale of emission

allowances, and pension deficit recovery.

T. Emission allowances

Emission allowances, which relate to the emissions of carbon

dioxide, are recorded as an intangible asset within current

assets and are initially recorded at cost, and subsequently at

the lower of cost and net realisable value. For allocations of

emission allowances granted by the UK Government, cost is

deemed to be equal to fair value at the date of allocation.

Receipts of such grants are treated as deferred income and are

recognised in the income statement in the period in which

carbon dioxide emissions are made. A provision is recorded in

respect of the obligation to deliver emission allowances and

charges are recognised in the income statement in the period in

which carbon dioxide emissions are made.

Income from the sale of emission allowances is reported as part

of other operating income.

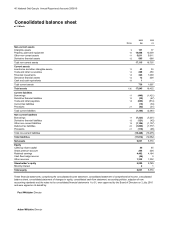

U. Cash and cash equivalents

Cash and cash equivalents include cash held at bank and in

hand, together with short-term highly liquid investments with an

original maturity of less than three months that are readily

convertible to known amounts of cash and subject to an

insignificant change in value and bank overdrafts, which are

reported in borrowings.

V. Other reserves

Other reserves comprise the capital redemption reserve arising

from the refinancing and restructuring of the Lattice Group in

1999. It represents the amount of the reduction in the share

capital of the Company as a consequence of that restructuring.

As the amounts included in other reserves are not attributable

to any of the other classes of equity presented, they have been

disclosed as a separate classification of equity.

W. Dividends

Interim dividends are recognised when they become payable to

the Company’s shareholders. Final dividends are recognised in

the financial year in which they are approved.

X. Areas of judgement and key sources of

estimation uncertainty

The preparation of financial statements requires management

to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosures of contingent

assets and liabilities and the reported amounts of revenue and

expenses during the reporting period. Actual results could differ

from these estimates. Information about such judgements and

estimation is contained in the accounting policies or the notes to