National Grid 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

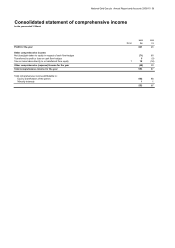

30 National Grid Gas plc Annual Report and Accounts 2009/10

Accounting policies

for the year ended 31 March 2010

A. Basis of preparation of consolidated financial

statements under IFRS

NGG’s principal activities involve the transmission and

distribution of gas and the provision of gas metering services

within Great Britain. The Company is a public limited company

incorporated and domiciled in England with its registered office

at 1-3 Strand, London WC2N 5EH.

These consolidated financial statements were approved for

issue by the Board of Directors on 2 July 2010.

These consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

(IFRS) as issued by the International Accounting Standards

Board and as adopted by the European Union. They are

prepared on the basis of all IFRS accounting standards and

interpretations that are mandatory for periods ending 31 March

2010 and in accordance with the Companies Act 2006

applicable to companies reporting under IFRS and Article 4 of

the European Union IAS regulation. The 2009 comparative

financial information has also been prepared on this basis.

The consolidated financial statements have been prepared on a

historical cost basis, except for the revaluation of derivative

financial instruments and investments classified as available for

sale.

These consolidated financial statements are presented in

pounds sterling, which is the functional currency of the

Company.

The preparation of financial statements requires management

to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosures of contingent

assets and liabilities and the reported amounts of revenue and

expenses during the reporting period. Actual results could differ

from these estimates.

B. Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries.

A subsidiary is defined as an entity controlled by the Company.

Control is achieved where the Company has the power to

govern the financial and operating policies of an entity so as to

obtain benefits from its activities.

Where necessary, adjustments are made to bring the

accounting policies used under UK generally accepted

accounting principles (UK GAAP) used in the individual financial

statements of the Company and its subsidiaries into line with

those used by the Company in its consolidated financial

statements under IFRS. Inter-company transactions are

eliminated.

C. Foreign currencies

Transactions in currencies other than the functional currency of

the Company or subsidiary concerned are recorded at the rates

of exchange prevailing on the dates of the transactions. At each

balance sheet date, monetary assets and liabilities that are

denominated in foreign currencies are retranslated at closing

exchange rates. Other non-monetary assets are not

retranslated unless they are carried at fair value.

Gains and losses arising on retranslation of monetary assets

and liabilities are included in the income statement.

On consolidation, the assets and liabilities of overseas financing

operations that have a functional currency different from the

Company’s functional currency of sterling are translated at

exchange rates prevailing at the balance sheet date. Income

and expense items are translated at the weighted average

exchange rates for the period. Exchange differences arising are

classified as equity and transferred to the consolidated

translation reserve.

D. Intangible assets

Identifiable intangible assets are recorded at cost less

accumulated amortisation and any provision for impairment.

Internally generated intangible fixed assets, such as software,

are recognised only if an asset is created that can be identified;

it is probable that the asset created will generate future

economic benefits; and that the development cost of the asset

can be measured reliably. Where no internally generated

intangible asset can be recognised, development expenditure is

recorded as an expense in the period in which it is incurred.

Intangible assets under development are not amortised. Other

non-current intangible assets are amortised on a straight-line

basis over their estimated useful economic lives. The principal

amortisation periods for categories of intangible assets are:

Amortisation periods Years

Software 3 to 5

Intangible emission allowances are accounted for in

accordance with accounting policy T.

E. Property, plant and equipment

Property, plant and equipment is recorded at cost less

accumulated depreciation and any impairment losses.

Cost includes payroll and finance costs incurred which are

directly attributable to the construction of property, plant and

equipment as well as the cost of any associated asset

retirement obligations.