National Grid 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 51

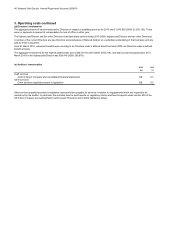

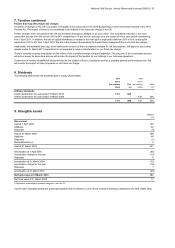

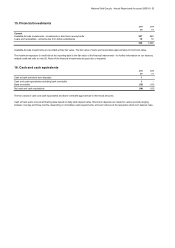

7. Taxation continued

Factors that may affect future tax charges

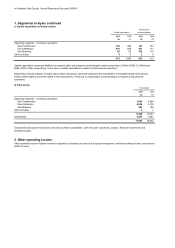

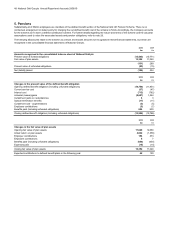

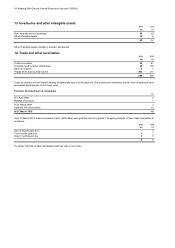

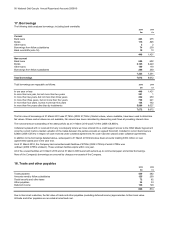

8. Dividends

The following table shows the dividends paid to equity shareholders:

2010 2009

pence pence

(per ordinary 2010 (per ordinary 2009

share) £m share) £m

Ordinary dividends

Interim dividend for the year ended 31 March 2010 7.61 300 --

Interim dividend for the year ended 31 March 2009 --7.61 300

7.61 300 7.61 300

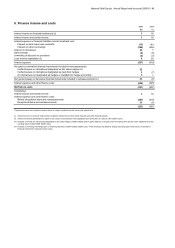

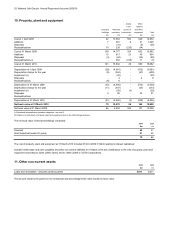

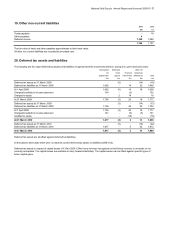

9. Intangible assets

Software

£m

Non-curren

t

Cost at 1 April 2008 125

A

dditions 32

Disposals (8)

Cost at 31 March 2009 149

A

dditions 68

Disposals (1)

Reclassifications (i) 5

Cost at 31 March 2010 221

A

mortisation at 1 April 2008 (65)

A

mortisation charge for the year (15)

Disposals 8

A

mortisation at 31 March 2009 (72)

A

mortisation charge for the year (19)

Disposals 1

A

mortisation at 31 March 2010 (90)

Net book value at 31 March 2010 131

Net book value at 31 March 2009 77

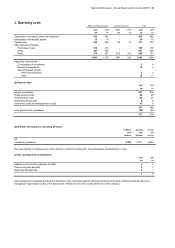

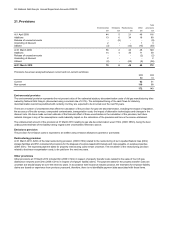

Furthermore a number of additional issues will also be the subject of future consultation such as a possible general anti-avoidance rule. We

will monitor the impact of these proposals on our future tax charge.

Further changes were announced in the UK Government's Emergency Budget on 22 June 2010. This included a reduction in the main

corporation tax rate from the current 28% to 24% comprising a 1% per annum reduction over the course of a four year period commencing

from 1 April 2011. In addition, the rate of capital allowances on assets in the main pool is expected to fall from 20% to 18% and long life

assets from 10% to 8% from 1 April 2012. We are in the process of evaluating the impact these changes will have on future tax charges.

Additionally, the worldwide debt cap, which restricts the amount of finance expense available for UK tax purposes, will apply for accounting

periods ended 31 March 2011 onwards but is not expected to have a material effect on our future tax charge.

There is currently ongoing consultation on the reform of the controlled foreign company legislation. The outcome of the consultation process

will not be known for some time and we will monitor the impact of the taxation on our holdings in our overseas operations.

A number of changes to the UK Corporation Tax system were announced in the 2010 Budget Report which have been enacted in the 2010

Finance Act. The impact of these is not considered to be material to the future tax charge in the UK.

(i) Represents reclassification between categories - see note 10.

Current other intangible assets are presented together with inventories in note 13 and consist of emissions allowances of £15m (2009: £5m).