National Grid 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 National Grid Gas plc Annual Report and Accounts 2009/10

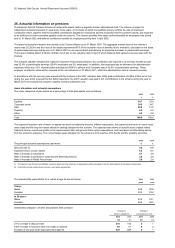

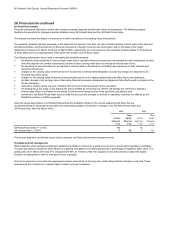

26. Actuarial information on pensions

Asset allocations and actuarial assumptions

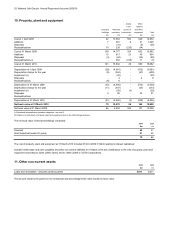

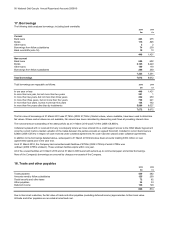

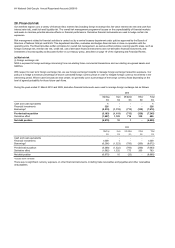

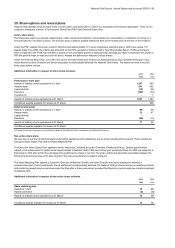

The major categories of plan assets as a percentage of total plan assets were as follows:

2010 2009

% %

Equities 34.7 33.9

Corporate bonds 34.5 34.7

Gilts 22.0 21.0

Property 6.2 5.5

Other 2.6 4.9

Total 100.0 100.0

2010 2009

The principal actuarial assumptions used were:

% %

Discount rate (i) 5.6 6.8

Expected return on plan assets 6.2 6.4

Rate of increase in salaries (ii) 4.7 3.8

Rate of increase in pensions in payment and deferred pensions 3.8 3.0

Rate of increase in Retail Prices Index 3.8 2.9

(i)

(ii) A promotional age related scale has been used where appropriate.

The assumed life expectations for a retiree at age 65 are as follows:

2010 2009

years years

Today:

Males 20.8 20.8

Females 23.3 23.2

In 20 years:

Males 23.2 23.1

Females 25.6 25.5

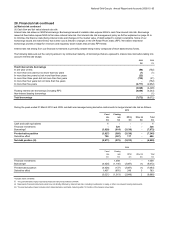

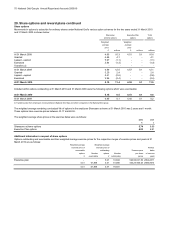

Sensitivities analysed - all other assumptions held constant:

Change in Change in

pension obligations annual pension cost

2010 2009 2010 2009

£m £m £m £m

0.1% increase in discount rate 210 143 21

0.5% increase in long term rate of increase in salaries 85 51 42

Increase of one year to life expectancies at age 60 430 269 21

The actuarial valuation showed that, based on long-term financial assumptions, the contribution rate required to meet future benefit accrual

was 32.4% of pensionable earnings (29.4% employers and 3% employees). In addition, the employers pay an allowance for administration

expenses which was 3.2% of pensionable earnings for 2009/10, giving a total Company rate of 32.6% of pensionable earnings. These

employer contribution rates will be reviewed at the next valuation on 31 March 2011, whilst the administration rate is reviewed annually.

The expected long-term rate of return on assets has been set reflecting the price inflation expectation, the expected real return on each major

asset class and the long-term asset allocation strategy adopted for the scheme. The expected real returns on specific asset classes reflect

historical returns, investment yields on the measurement date and general future return expectations, and have been set after taking advice

from the scheme's actuaries. The current target asset allocation for the scheme is 33% equities, 59% bonds and 8% property and other.

The discount rate for pension liabilities has been determined by reference to appropriate yields prevailing in the UK debt markets at the balance sheet date.

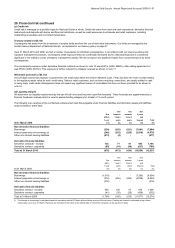

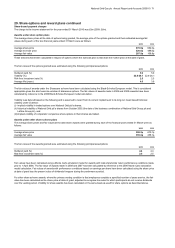

The latest full actuarial valuation was carried out by Towers Watson as at 31 March 2007. The aggregate market value of the scheme’s

assets was £12,923m and the value of the assets represented 97% of the actuarial value of benefits due to members, calculated on the basis

of pensionable earnings and service at 31 March 2007 on an ongoing basis and allowing for projected increases in pensionable earnings.

There was a funding deficit of £442m (£309m net of tax) on the valuation date in light of which National Grid agreed a recovery plan with the

trustees.

In accordance with the recovery plan agreed with the trustees at the 2007 valuation date, NGG paid contributions of £58m (£42m net of tax)

during the year which ensured that the deficit reported in the 2007 valuation was paid in full. Contributions to the scheme during the year to

March 2011 are expected to comprise ongoing normal contributions only.

The National Grid UK Pension Scheme is funded with assets held in a separate trustee administered fund. The scheme is subject to

independent actuarial valuation at least every three years, on the basis of which the qualified actuary certifies the rate of employers'

contribution which, together with the specified contributions payable by employees and the proceeds from the scheme's assets, are expected

to be sufficient to fund the benefits payable under the scheme. The scheme provides final salary defined benefits for employees who joined

prior to 31 March 2002 and defined contribution benefits for employees joining from 1 April 2002.