National Grid 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Grid Gas plc Annual Report and Accounts 2009/10 35

the financial statements, and the key areas are summarised

below.

Areas of judgement that have the most significant effect on the

amounts recognised in the financial statements:

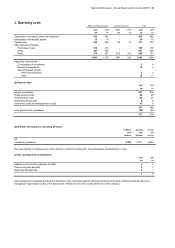

The categorisation of certain items as exceptional items

and remeasurements and the definition of adjusted

earnings – note 4.

The exemptions adopted on transition to IFRS on 1 April

2004.

The recognition of defined benefit pension costs as if the

National Grid UK Pension Scheme was a defined

contribution scheme – accounting policy M.

Hedge accounting – accounting policy P.

Key sources of estimation uncertainty that have a significant

risk of causing a material adjustment to the carrying amounts of

assets and liabilities within the next financial year:

Review of residual lives, carrying values and impairment

charges for intangible assets and property, plant and

equipment – accounting policies D, E and F.

Valuation of financial instruments and derivatives – notes

12, 15 and 27.

Revenue recognition and assessment of unbilled revenue

– accounting policy K.

Environmental provisions – note 21.