National Grid 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 National Grid Gas plc Annual Report and Accounts 2009/10

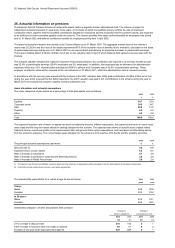

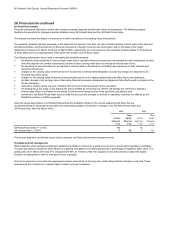

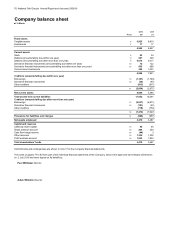

28. Financial risk continued

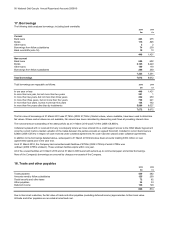

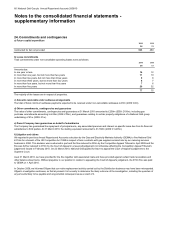

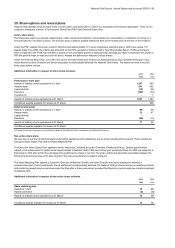

(b) Fair value disclosures

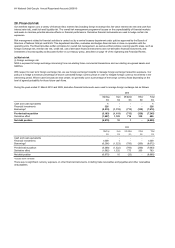

The levels are classified as follows:

Level 1 Level 2 Level 3 Total

£m £m £m £m

Assets

A

vailable-for-sale investments 307 - - 307

Derivative financial instruments - 635 2 637

307 635 2 944

Liabilities

Derivative financial instruments - (151) - (151)

- (151) - (151)

Total 307 484 2 793

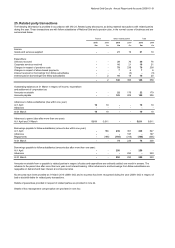

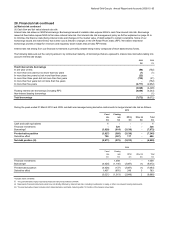

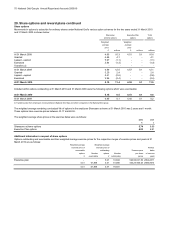

The changes in the value of our level 3 derivative financial instruments are as follows:

Derivative

financial

instruments

£m

At 1 April 2009 (1)

Total recognised income and expense for the year (i) 3

Settlements -

At 31 March 2010 2

(i) Gains of £3m are attributable to assets or liabilities held at the end of the reporting period.

Level 3: Financial instruments valued using techniques where one or more significant inputs are based on unobservable market data.

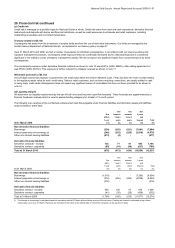

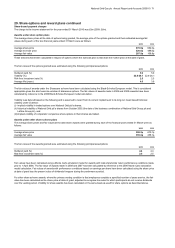

The best evidence of fair value is a quoted price in an actively traded market. In the event that the market for a financial instrument is not

active, a valuation technique is used.

The fair value classification of our financial assets and financial liabilities is as follows:

2010

The financial instruments classified as level 3 are currency swaps where the currency forward curve is illiquid.

Level 1: Financial instruments with quoted prices for identical instruments in active markets.

Level 2: Financial instruments with quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments

in inactive markets and financial instruments valued using models where all significant inputs are based directly or indirectly on observable

market data.

The following is an analysis of our financial instruments measured at fair value. They are reported in a tiered hierarchy based on the valuation

methodology described on page 21, and reflecting the significance of market observable inputs.