National Grid 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 65

28. Financial risk continued

(a) Market risk continued

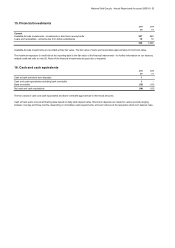

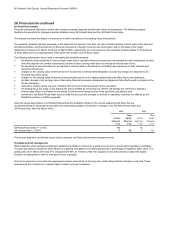

(ii) Cash flow and fair value interest rate risk

Interest rate risk arising from our financial investments is primarily variable being mainly composed of short dated money funds.

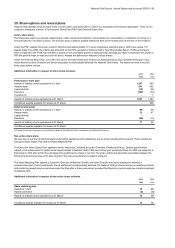

2010 2009

£m £m

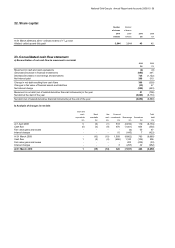

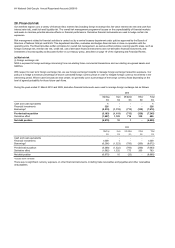

Fixed interest rate borrowings

In one year or less (98) (702)

In more than one year but not more than two years (1) (1)

In more than two years but not more than three years (22) -

In more than three years but not more than four years (730) (21)

In more than four years but not more than five years -(752)

In more than five years (2,777) (2,952)

(3,628) (4,428)

Floating interest rate borrowings (including RPI) (4,044) (4,243)

Non-interest bearing borrowings -(1)

Total borrowings (7,672) (8,672)

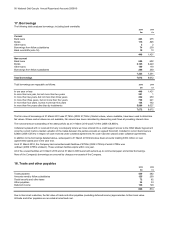

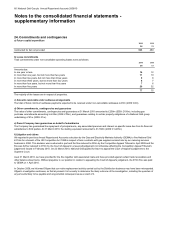

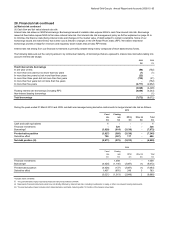

2010

Fixed Floating

rate rate RPI (i) Other (ii) Total

£m £m £m £m £m

Cash and cash equivalents 1---1

Financial investments - 326 - - 326

Borrowings* (3,628) (914) (3,130) - (7,672)

Pre-derivative position (3,627) (588) (3,130) - (7,345)

Derivative effect 756 (387) 117 - 486

Net debt position (iii) (2,871) (975) (3,013) - (6,859)

2009

Fixed Floating

rate rate RPI(i) Other (ii) Total

£m £m £m £m £m

Financial investments - 1,009 - - 1,009

Borrowings* (4,428) (1,146) (3,097) (1) (8,672)

Pre-derivative position (4,428) (137) (3,097) (1) (7,663)

Derivative effect 1,407 (876) 249 3 783

(3,021) (1,013) (2,848) 2 (6,880)

*Includes bank overdrafts

(i) The post-derivative impact represents financial instruments linked to UK RPI.

(ii)

(iii) The post derivative impact includes short dated derivative contracts maturing within 12 months of the balance sheet date.

During the years ended 31 March 2010 and 2009, net debt was managed using derivative instruments to hedge interest rate risk as follows:

The following table sets out the carrying amount, by contractual maturity, of borrowings that are exposed to interest rate risk before taking into

account interest rate swaps:

Interest rate risk arises on NGG's borrowings. Borrowings issued at variable rates expose NGG to cash flow interest rate risk. Borrowings

issued at fixed rates expose NGG to fair value interest rate risk. Our interest rate risk management policy as further explained on page 20 is

to minimise the finance costs (being interest costs and changes in the market value of debt) subject to certain constraints. Some of our

borrowings issued are index-linked, that is their cost is linked to changes in the UK Retail Prices Index (RPI). We believe that these

borrowings provide a hedge for revenues and regulatory asset values that are also RPI-linked.

Represents financial instruments which are not directly affected by interest rate risk, including investments in equity or other non-interest bearing instruments.