National Grid 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 National Grid Gas plc Annual Report and Accounts 2009/10

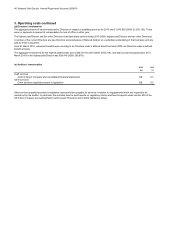

Adoption of new accounting standards

New IFRS accounting standards and interpretations adopted in 2009/10

During the year ended 31 March 2010, NGG adopted the following International Financial Reporting Standards (IFRS), International

Accounting Standards (IAS) or amendments and interpretations by the International Financial Reporting Interpretations Committee

(IFRIC). The impact of IFRIC 18 is to increase operating profit for the year ended 31 March 2010 and reduce liabilities at 31 March

2010 by £10m. In accordance with the transition provisions of IFRIC 18 ‘Transfers of assets from customers’, comparative amounts

have not been restated. None of the other pronouncements had a material impact on NGG’s consolidated results or assets and

liabilities.

IFRIC 18 on transfers of assets from

customers

Addresses arrangements whereby an entity receives items of property, plant and equipment or cash which the

entity must use to connect customers to a network or provide access to a supply of goods or services, or both.

IAS 1 revised on the presentation

of financial statements

Requires changes to the presentation of financial statements and adopts revised titles for the primary

statements, although companies may continue to use the existing titles.

Amendment to IFRS 7 on improving

disclosures about financial instruments

Introduces a three-level hierarchy for fair value measurement disclosures and requires entities to provide

additional disclosures about the relative reliability of fair value measurements. In addition, the amendment

clarifies and enhances existing requirements for the disclosure of liquidity risk. The additional information

required by this amendment can be found in note 28.

IFRS 8 on operating segments Sets out the requirements for the disclosure of information about an entity’s operating segments and about the

entity’s products and services, the geographical areas in which it operates and its major customers.

IAS 23 revised on borrowing costs Removes the option of immediately recognising as an expense borrowing costs that relate to assets that take a

substantial period of time to get ready for use or sale.

IFRIC 13 on customer loyalty

programmes

Clarifies that the sale of goods or services together with customer award credits (for example, loyalty points or

the right to free products) is accounted for as a multiple-element transaction. The consideration received from

the customer is allocated between the components of the arrangement based on their fair values, which will

defer the recognition of some revenue.

Amendment to IFRS 2 on share-based

payments

Clarifies the definition of vesting conditions and the accounting treatment of cancellations. Vesting conditions

are defined as either service conditions or performance conditions. Cancellations by employees are accounted

for in the same way as cancellations by the Company.

Amendments to IAS 32 and IAS 1 on

puttable financial instruments and

obligations arising on liquidation

Addresses the classification as a liability or as equity of certain puttable financial instruments and instruments,

or components thereof, which impose upon an entity an obligation to deliver a pro rata share of net assets on

liquidation.

Amendment to IFRS 1 First-time

Adoption of International Financial

Reporting Standards and IAS 27

Consolidated and Separate Financial

Statements on the cost of an Investment

in a Subsidiary, Jointly Controlled Entity

or Associate

Permits investments to be recognised on first-time adoption of IFRS at cost or deemed cost (fair value or

previous GAAP carrying amount) and removes the requirement to recognise dividends out of pre-acquisition

profits as a reduction in the cost of the investment.

Improvements to IFRS 2008 Contains amendments to various existing standards.

IFRIC 15 on agreements for the

construction of real estate

Addresses the timing of revenue recognition for entities engaged in the construction of real estate for their

customers.

IFRIC 16 on hedges of a net investment

in a foreign operation

Clarifies that a hedged risk may be designated at any level in a group and hedging instruments may be held by

any company in a group (except the foreign entity being hedged), that net investment hedge accounting may

not be adopted in respect of a presentation currency and that on disposal the amounts to be reclassified from

equity to profit or loss are any cumulative gain or loss on the hedging instrument and the cumulative translation

difference on the foreign operation disposed of.

Amendment to IAS 39 Financial

Instruments: Recognition and

measurement: Reclassification of

Financial Assets: Effective Date and

Transition

Clarifies the effective date of the reclassification of financial assets.

Amendments to IAS 39 and IFRIC 9 on

embedded derivatives

Requires reassessment of whether an embedded derivative should be separated out if a financial asset is

reclassified out of the fair value through profit or loss category.