National Grid 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 National Grid Gas plc Annual Report and Accounts 2009/10

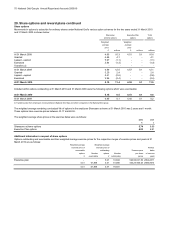

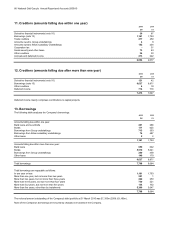

11. Creditors (amounts falling due within one year)

2010 2009

£m £m

Derivative financial instruments (note 10) 30 67

Borrowings (note 13) 1,161 1,793

Trade creditors 277 259

A

mounts owed to Group undertakings 48

A

mounts owed to fellow subsidiary undertakings 152 204

Corporation tax -31

Social security and other taxes 73 63

Other creditors 34 30

A

ccruals and deferred income 273 222

2,004 2,677

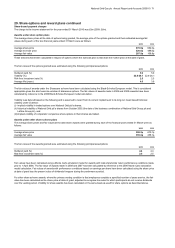

12. Creditors (amounts falling due after more than one year)

2010 2009

£m £m

Derivative financial instruments (note 10) 121 42

Borrowings (note 13) 6,637 6,871

Other creditors 418

Deferred income 714 716

7,476 7,647

Deferred income mainly comprises contributions to capital projects.

13. Borrowings

The following table analyses the Company's borrowings:

2010 2009

£m £m

A

mounts falling due within one year:

Bank loans and overdrafts 261 286

Bonds 111 625

Borrowings from Group undertakings 713 393

Borrowings from fellow subsidiary undertakings 74 487

Other loans 22

1,161 1,793

A

mounts falling due after more than one year:

Bank loans 659 602

Bonds 5,579 5,641

Borrowings from Group undertakings 250 458

Other loans 149 170

6,637 6,871

Total borrowings 7,798 8,664

Total borrowings are repayable as follows:

In one year or less 1,161 1,793

More than one year, but not more than two years 251 1

More than two years, but not more than three years 222 250

More than three years, but not more than four years 730 221

More than four years, but not more than five years 134 752

More than five years, other than by instalments 5,300 5,647

7,798 8,664

The notional amount outstanding of the Company's debt portfolio at 31 March 2010 was £7,355m (2009: £8,166m).

None of the Company's borrowings are secured by charges over assets of the Company.