National Grid 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74 National Grid Gas plc Annual Report and Accounts 2009/10

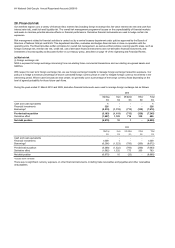

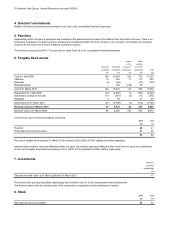

F. Taxation

Current tax for the current and prior periods is provided at the

amount expected to be paid (or recovered) using the tax rates

and tax laws that have been enacted or substantively enacted

by the balance sheet date. Current tax assets and liabilities

arising from transfer pricing adjustments, which are expected to

be fully recovered through group relief, are initially estimated

and recognised in the current year where material. Further

adjustments are recognised when tax returns are submitted to

the tax authorities.

Deferred tax is provided in full on timing differences which result

in an obligation at the balance sheet date to pay more tax, or

the right to pay less tax, at a future date, at tax rates expected

to apply when the timing differences reverse, based on tax

rates and tax laws that have been enacted or substantively

enacted by the balance sheet date. Timing differences arise

from the inclusion of items of income and expenditure in

taxation computations in periods different from those in which

they are included in the financial statements. Deferred tax

assets are recognised to the extent that it is regarded as more

likely than not that they will be recovered. Deferred tax assets

and liabilities are not discounted.

G. Stocks

Stocks are stated at cost less provision for deterioration and

obsolescence.

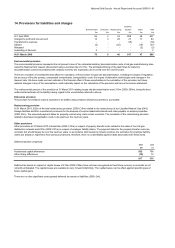

H. Environmental costs

Environmental costs, based on discounted future estimated

expenditures expected to be incurred, are provided for in full.

The unwinding of the discount is included within the profit and

loss account as a financing charge.

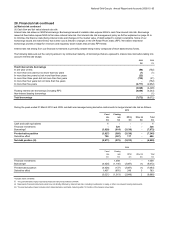

I. Revenue

Revenue represents the sales value derived from the

transmission and distribution of gas and the provision of gas

metering services during the year, including an assessment of

services provided, but not invoiced as at the year end. It

excludes value added tax and intra-group sales.

Where revenue for the year exceeds the maximum amount

permitted by regulatory agreement and adjustments will be

made to future prices to reflect this over-recovery, a liability for

the over-recovery is not recognised as such an adjustment to

future prices relates to the provision of future services. Similarly,

an asset is not recognised where a regulatory agreement

permits adjustments to be made to future prices in respect of an

under-recovery.

J. Replacement expenditure

Replacement expenditure is recognised within operating costs

and represents the cost of planned maintenance of mains and

services assets by replacing or lining sections of pipe. This

expenditure is principally undertaken to repair and maintain the

safety of the network and is written off as incurred. Expenditure

that enhances the performance of mains and services assets is

treated as an addition to tangible fixed assets.

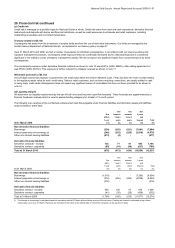

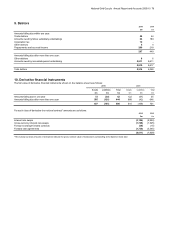

K. Pensions

The substantial majority of the Company’s employees are

members of the defined benefit section of the National Grid UK

Pension Scheme. There is no contractual arrangement or

stated policy for charging the net defined benefit cost of the

scheme to the Company. Accordingly, the Scheme is

recognised in these Company financial statements as if it were

a defined contribution scheme. The pension charge for the year

represents the contributions payable to the Scheme for the

period. A share of the assets and liabilities or the actuarial gains

and losses of the Scheme are not recognised in these

Company financial statements.

L. Leases

Operating lease payments are charged to the profit and loss

account on a straight-line basis over the term of the lease.

M. Financial instruments

Financial assets, liabilities and equity instruments are classified

according to the substance of the contractual arrangements

entered into. An equity instrument is any contract that

evidences a residual interest in the assets of the Company after

deducting all of its liabilities and is recorded at the proceeds

received, net of direct issue costs.

Loans receivable are carried at amortised cost using the

effective interest rate method less any allowance for estimated

impairments. A provision is established for impairments when

there is objective evidence that the Company will not be able to

collect all amounts due under the original terms of the loan.

Interest income, together with losses when the loans are

impaired, is recognised on an effective interest rate basis in the

profit and loss account.

Current asset financial investments are recognised at fair value

plus directly related incremental transaction costs and are

subsequently carried at fair value on the balance sheet.

Changes in the fair value of investments classified as available-

for-sale are recognised directly in equity, until the investment is

disposed of or is determined to be impaired. At this time the

cumulative gain or loss previously recognised in equity is

included in net profit or loss for the period. Investment income

on investments classified as available-for-sale is recognised in

the profit and loss account as it accrues.

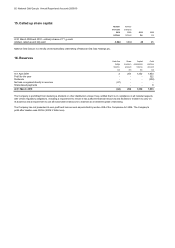

Borrowings, which include interest-bearing loans, UK Retail

Prices Index (RPI) linked debt and overdrafts, are recorded at

their initial fair value which normally reflects the proceeds

received, net of direct issue costs less any repayments.

Subsequently these are stated at amortised cost, using the

effective interest rate method. Any difference between proceeds

and the redemption value is recognised over the term of the

borrowing in the profit and loss account using the effective

interest rate method.

Derivative financial instruments are recorded at fair value, and

where the fair value of a derivative is positive, it is carried as a

derivative asset and where negative, as a liability. Assets and

liabilities on different transactions are only netted if the