National Grid 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 National Grid Gas plc Annual Report and Accounts 2009/10

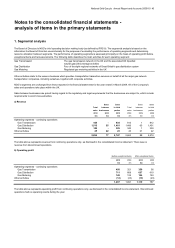

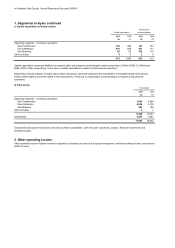

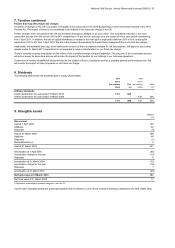

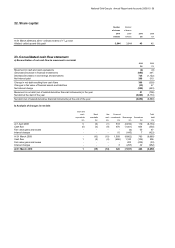

7. Taxation

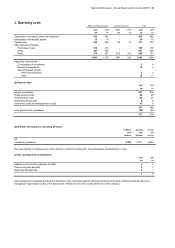

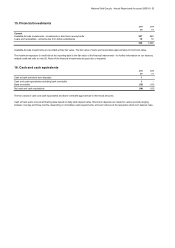

Taxation on items charged/(credited) to the income statemen

t

The tax charge for the year can be analysed as follows:

Before exceptional items Exceptional items

and remeasurements and remeasurements Total

2010 2009 2010 2009 2010 2009

£m £m £m £m £m £m

United Kingdom

Corporation tax at 28% 196 180 (34) (105) 162 75

Corporation tax adjustment in respect of prior years (5) 105 --(5) 105

191 285 (34) (105) 157 180

Deferred tax 129 110 -24 129 134

Deferred tax adjustment in respect of prior years 2(2) --2(2)

131 108 -24 131 132

Total tax charge/(credit) 322 393 (34) (81) 288 312

Taxation on items (credited)/charged to equit

y

2010 2009

£m £m

Deferred tax (credit)/charge on revaluation of cash flow hedges (18) 14

Tax (credit)/charge recognised in consolidated statement of comprehensive income (18) 14

Deferred tax charge on share-based payments recognised directly in equity -2

(18) 16

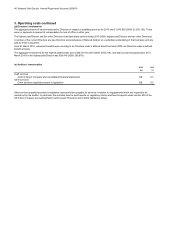

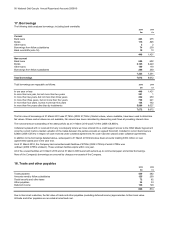

Before After Before After

exceptional exceptional exceptional exceptional

items and items and items and items and

remeasure- remeasure- remeasure- remeasure-

ments ments ments ments

2010 2010 2009 2009

£m £m £m £m

Profit before taxation

Before exceptional items and remeasurements 1,043 1,043 690 690

Exceptional items and remeasurements - (154) - (330)

Profit before taxation from continuing operations 1,043 889 690 360

Profit on continuing operations multiplied by the rate of corporation

tax in the UK of 28% (2009: 28%) 292 249 193 101

Effects of:

A

djustments in respect of prior years (3) (3) 103 103

Expenses not deductible for tax purposes 3477

Non-taxable income --(1) (1)

Impact of employee share schemes --22

Other 30 38 89 100

Total taxation from continuing operations 322 288 393 312

% % % %

A

t the effective income tax rate 30.9 32.4 57.0 86.7

The tax charge for the year after exceptional items and remeasurements is higher (2009: higher) than the standard rate of corporation tax in

the UK of 28% (2009: 28%). The differences are explained below: