National Grid 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 19

NGG’s liquidity position are provided under the heading

Liquidity and treasury management below and in note 28 to the

consolidated financial statements.

Financial position

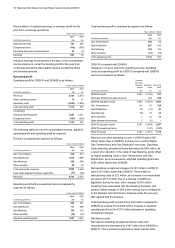

Balance sheet

The balance sheet at 31 March 2010 can be summarised as

follows:

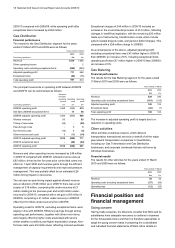

Assets Liabilities

Net

assets

£m £m £m

Property, plant and equipment

and non-current intangible assets 10,939 - 10,939

Current assets and liabilities 331 (887) (556)

Other non-current assets and liabilities 5,611 (1,214) 4,397

Deferred tax - (1,890) (1,890)

Total before net debt 16,881 (3,991) 12,890

Net debt 964 (7,823) (6,859)

Total as at 31 March 2010 17,845 (11,814) 6,031

Total as at 31 March 2009 18,432 (12,662) 5,770

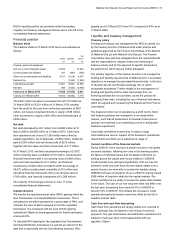

The £261 million increase in net assets from £5,770 million at

31 March 2009 to £6,031 million at 31 March 2010 resulted

from the profit for the year from continuing operations of £601

million, net losses recognised directly in equity of £48 million,

other movements in equity of £8 million and dividends paid of

£300 million.

Net debt

Net debt decreased by £21 million from £6,880 million at 31

March 2009 to £6,859 million at 31 March 2010. Cash flows

from operations net of tax of £1,563 million were offset by

capital expenditure, net of disposals, of £952 million, dividends

paid of £300 million and net interest paid of £273 million,

together with fair value and other movements of £17 million.

At 31 March 2010, net debt comprised borrowings of £7,672

million including bank overdrafts of £15 million, less derivative

financial instruments with a net carrying value of £486 million,

cash and cash equivalents of £1 million, and financial

investments of £326 million (31 March 2009: borrowings of

£8,672 million including bank overdrafts of £10 million less

derivative financial instruments with a net carrying value of

£783 million, and financial investments of £1,009 million).

The maturity of borrowings is shown in note 17 to the

consolidated financial statements.

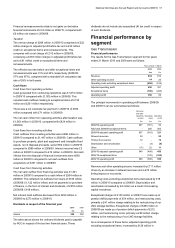

Capital structure

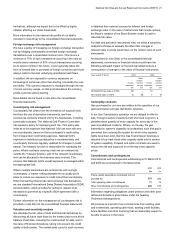

We monitor the regulatory asset value (RAV) gearing within the

Gas Transmission and Gas Distribution businesses. This is

calculated as net debt expressed as a percentage of RAV, and

indicates the level of debt employed to fund the regulated

businesses. It is compared with the level of RAV gearing

indicated by Ofgem as being appropriate for these businesses,

at around 60%.

To calculate RAV gearing for the regulated Gas Transmission

and Gas Distribution businesses we exclude an element of the

debt that is associated with the Gas Metering business. RAV

gearing as at 31 March 2010 was 57% compared to 60% as at

31 March 2009.

Liquidity and treasury management

Treasury policy

Funding and treasury risk management for NGG is carried out

by the treasury function of National Grid under policies and

guidelines approved by the Finance Committees of the Boards

of National Grid plc and National Grid Gas plc. The Finance

Committees have authority delegated from the relevant Boards

and are responsible for regular review and monitoring of

treasury activity and for the approval of specific transactions,

the authority for which may be further delegated.

The primary objective of the treasury function is to manage the

funding and liquidity requirements of National Grid. A secondary

objective is to manage the associated financial risks, in the form

of interest rate risk and foreign exchange risk, to within

acceptable boundaries. Further details of the management of

funding and liquidity and the main risks arising from our

financing activities are set out below, as are the policies for

managing these risks, including the use of financial derivatives,

which are agreed and reviewed by the Boards and the Finance

Committees.

The treasury function is not operated as a profit centre. Debt

and treasury positions are managed in a non speculative

manner, such that all transactions in financial instruments or

products are matched to an underlying current or anticipated

business requirement.

Commodity derivatives entered into in respect of gas

commodities are used in support of the business’s operational

requirements and their use is explained on page 21.

Current condition of the financial markets

During 2009/10, there has been a partial recovery in the global

economic situation, following the crisis in the banking system,

the failure of individual banks and increased restrictions on

lending across the capital and money markets in 2008/09.

Credit spreads have narrowed significantly. With our low risk

business model and cash flows that are largely stable over a

period of years, we were able to access the markets during

2008/09 and have continued to do so in 2009/10, having issued

£366 million of long-term debt into the capital markets. We

remain confident of our ability to access the public debt markets

in the future. The cost of our new long-term debt has fallen over

the last year, decreasing from around 6.0% in 2008/09 to

around 3.0% in 2009/10. This reflects the increase in credit

spreads demanded by lenders more than offset by the fall in

headline interest rates.

Cash flow and cash flow forecasting

Cash flows from operations are largely stable over a period of

years, although they do depend on the timing of customer

payments. Our gas transmission and distribution operations are

subject to multi-year price control agreements with our

regulator, Ofgem.