National Grid 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 17

Financial remeasurements relate to net gains on derivative

financial instruments of £33 million in 2009/10, compared with

£6 million net losses in 2008/09.

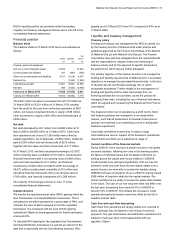

Taxation

The net tax charge of £288 million in 2009/10 comprised a £322

million charge on adjusted profit before tax and a £34 million

credit on exceptional items and remeasurements. This

compares with a net charge of £312 million in 2008/09,

comprising a £393 million charge on adjusted profit before tax

and a £81 million credit on exceptional items and

remeasurements.

The effective tax rate before and after exceptional items and

remeasurements was 31% and 32% respectively (2008/09:

57% and 87%), compared with a standard UK corporation tax

rate of 28% in both years.

Cash flows

Cash flows from operating activities

Cash generated from continuing operations was £1,872 million

in 2009/10 compared with £1,005 million in 2008/09. This

included cash outflows relating to exceptional items of £123

million and £261 million respectively.

There was a net corporate tax payment in 2009/10 of £309

million compared with £71 million in 2008/09.

The net cash inflow from operating activities after taxation was

£1,563 million in 2009/10, compared with £934 million in

2008/09.

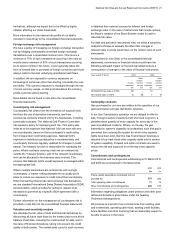

Cash flows from investing activities

Cash outflows from investing activities were £266 million in

2009/10 compared to £1,447 million in 2008/09. Cash outflows

to purchase property, plant and equipment and intangible fixed

assets, net of disposal proceeds, were £952 million in 2009/10

compared to £989 million in 2008/09. Interest received was £3

million in 2009/10 compared to £19 million in 2008/09. Net cash

inflows from the disposal of financial investments were £683

million in 2009/10 compared to net cash outflows from

acquisitions of £491 million in 2008/09.

Cash flows from financing activities

The net cash outflow from financing activities was £1,301

million in 2009/10 compared to a cash inflow of £504 million in

2008/09. This reflected net outflows from loans of £725 million

(2008/09: £1,122 million inflow) and net payments to providers

of finance, in the form of interest and dividends, of £576 million

(2008/09: £618 million).

Net interest cash outflows decreased from £299 million in

2008/09 to £273 million in 2009/10.

Dividends in respect of the financial year

2010 2009

£m £m

Interim 300 300

The table above shows the ordinary dividends paid or payable

by NGG in respect of the last two financial years. These

dividends do not include any associated UK tax credit in respect

of such dividends.

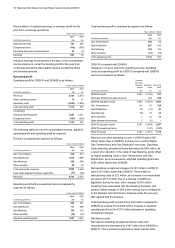

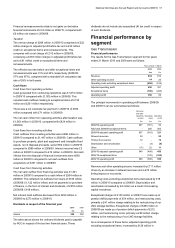

Financial performance by

segment

Gas Transmission

Financial performance

The results for the Gas Transmission segment for the years

ended 31 March 2010 and 2009 were as follows:

Years ended 31 March

2010 2009

£m £m

Revenue 934 812

Other operating income 14 25

Operating costs excluding exceptional items (498) (516)

Adjusted operating profit 450 321

Exceptional items (100) (265)

Operating profit 350 56

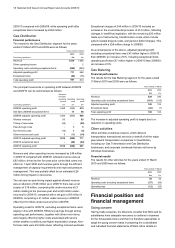

The principal movements in operating profit between 2008/09

and 2009/10 can be summarised as follows:

Revenue

and othe

r

operating

income

Operating

costs

Operating

profit

£m £m £m

2008/09 operating profit 837 (781) 56

Add back 2008/09 exceptional items - 265 265

2008/09 adjusted operating profit 837 (516) 321

Allowed revenues 50 - 50

Timing of recoveries 72 - 72

Depreciation and amortisation - (4) (4)

Other (11) 22 11

2009/10 adjusted operating profit 948 (498) 450

2009/10 exceptional items - (100) (100)

2009/10 operating profit 948 (598) 350

Revenue and other operating income increased by £111 million

driven by an increase in allowed revenues and a £72 million

timing impact on recoveries.

Operating costs excluding exceptional items decreased by £18

million in 2009/10 compared to 2008/09. Depreciation and

amortisation increased by £4 million as a result of increasing

capital investment.

Exceptional charges of £100 million in 2009/10 are made up of

pension deficit payments of £54 million, and restructuring costs,

primarily a £41 million charge relating to the restructuring of our

LNG storage facilities. Exceptional charges of £265 million in

2008/09 are made up of pension deficit payments of £212

million, and restructuring costs, primarily a £50 million charge

relating to the restructuring of our LNG storage facilities.

As a consequence of these items, adjusted operating profit,

excluding exceptional items, increased by £129 million in