National Grid 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 15

on the basis that they are material, either by virtue of their

nature or size, and are relevant to an understanding of our

financial performance. Items of income or expense that are

considered by management for designation as exceptional

items include such items as significant restructurings, write-

downs or impairments of non-current assets, significant

changes in environmental provisions and gains or losses on

disposals of businesses or investments.

Remeasurements comprise gains or losses recorded in the

income statement arising from changes in the fair value of

derivative financial instruments. These fair values increase or

decrease as a consequence of changes in financial indices and

prices over which we have no control.

Adjusted profit measures are limited in their usefulness

compared with the comparable total profit measures, as they

exclude important elements of underlying financial

performance, namely exceptional items and remeasurements.

We believe that in separately presenting financial performance

in two components it is easier to read and interpret financial

performance between periods, as adjusted profit measures are

more comparable by excluding the distorting effect of

exceptional items and remeasurements, and exceptional items

and remeasurements are more clearly understood if separately

identified and analysed. The presentation of these two

components of financial performance is additional to, and not a

substitute for, the comparable total profit measures presented.

Management uses adjusted profit measures as the basis for

monitoring financial performance and in communicating

financial performance to investors in external presentations and

announcements of financial results. Internal financial reports,

budgets and forecasts are primarily prepared on the basis of

adjusted profit measures, although planned exceptional items,

such as significant restructurings, are also reflected in budgets

and forecasts. Management compensates for the limitations

inherent in the use of adjusted profit measures through the

separate monitoring and disclosure of exceptional items and

remeasurements as a component of our overall financial

performance.

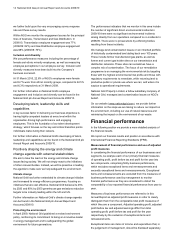

Profit for the year from continuing operations

Profit for the year from continuing operations increased from

£48 million in 2008/09 to £601 million in 2009/10 as a

consequence of the changes in operating profit, net finance

costs, exceptional finance costs and remeasurements, and

taxation described in the following sections:

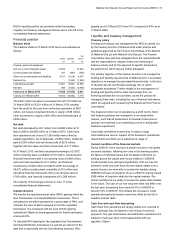

Adjusted earnings

Years ended 31 March

2010 2009

Continuing operations £m £m

Adjusted operating profit 1,297 1,091

Net finance costs excluding

exceptional items and remeasurements (254) (401)

Adjusted profit before taxation 1,043 690

Taxation excluding taxation on

exceptional items and remeasurements (322) (393)

Adjusted profit for the year from continuing operations 721 297

Earnings

Years ended 31 March

2010 2009

Continuing operations £m £m

Total operating profit 1,110 767

Net finance costs (221) (407)

Profit before taxation 889 360

Taxation (288) (312)

Profit for the year from continuing operations 601 48

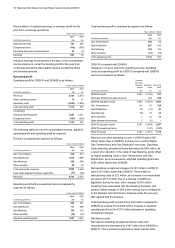

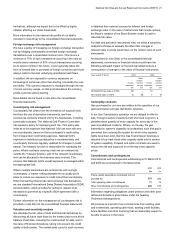

Adjusted profit measures

The following tables reconcile the adjusted profit measure to the

corresponding total profit measure in accordance with IFRS.

Reconciliation of adjusted operating profit to total operating

profit

Years ended 31 March

2010 2009

Continuing operations £m £m

Adjusted operating profit 1,297 1,091

Exceptional items (187) (324)

Total operating profit 1,110 767

Adjusted operating profit is presented on the face of the

consolidated income statement, under the heading operating

profit before exceptional items.

Reconciliation of adjusted profit before taxation to profit before

taxation

Years ended 31 March

2010 2009

Continuing operations £m £m

Adjusted profit before taxation 1,043 690

Exceptional items (187) (324)

Derivative financial remeasurements 33 (6)

Total profit before taxation 889 360

Adjusted profit before taxation is presented on the face of the

consolidated income statement, under the heading profit before

taxation before exceptional items and remeasurements.