National Grid 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

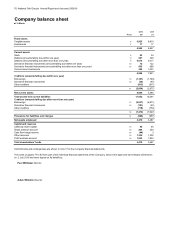

National Grid Gas plc Annual Report and Accounts 2009/10 77

Notes to the Company financial statements

1

.

Ad

op

ti

on o

f

new accoun

ti

ng s

t

an

d

ar

d

s

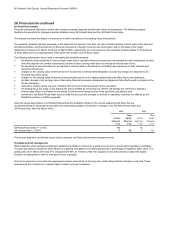

New financial reporting standards (FRS) and abstracts adopted in 2009/1

0

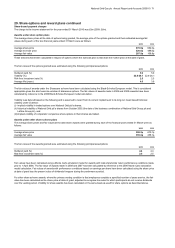

Amendment to FRS 20 on share-based payments

Improvements to FRS 2008

New FRS not yet adopte

d

FRS 30 on heritage assets

Improvements to FRS 2009

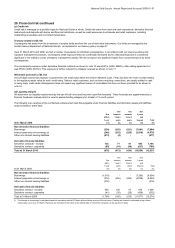

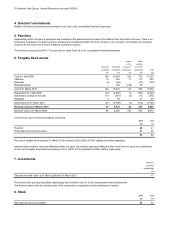

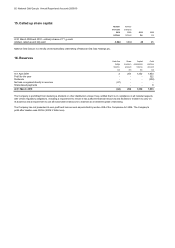

2. Auditors' remuneration

A

uditors' remuneration in respect of the Company is set out below:

2010 2009

£m £m

A

udit services

A

udit fee of Company 0.2 0.3

Other services

Other services supplied pursuant to legislation 0.2 0.2

3. Number of employees, including Directors

2010 2009

Average Average

number number

United Kingdom - continuing operations 5,678 6,016

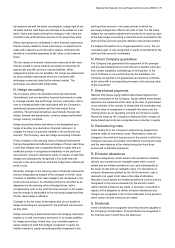

Enhances disclosures about fair value and liquidity risk.

Contains amendments to various existing standards.

UITF 46 on hedges of a net investment in a foreign

operation

Clarifies that hedged risk may be designated at any level in a group and hedging instruments may be

held by any Company in a group (except the foreign entity being hedged), that net investment hedge

accounting may not be adopted in respect of a presentation currency and that on disposal the amounts

to be reclassifed from equity to profit or loss are any cumulative gain or loss on the hedging instrument

and the cumulative translation difference on the forein

g

o

p

eration dis

p

osed of.

Amendment to FRS 25 on puttable financial

instruments and obligations arising on liquidation

Clarifies the scope and accounting for group cash settled share based payment transactions in separate

and individual financial statements when there is no obligation to settle the share based payment

transaction. The amendment to FRS 20 will be adopted by the Company with effect from 1 April 2010.

Amendment to FRS 25 on classification of rights

issues

Other services supplied pursuant to legislation represents fees payable for services in relation to engagements which are required to be

carried out by the auditor. In particular, this includes fees for audit reports on regulatory returns and fees for reports under section 404 of the

US Public Company Accounting Reform and Investor Protection Act of 2002 (Sarbanes-Oxley).

During the year the Company has adopted the following FRSs and abstracts. None of these had a material impact on the Company's results

or assets and liabilities.

Defines as an equity instrument a financial instrument that gives the holder the right to acquire a fixed

number of the entity's equity instrument for a fixed amount of any currency, if the financial instrument is

offered pro rata to all existing owners of the same class of non-derivative equity instruments. The

amendment to FRS 25 has been adopted by the Company with effect from 1 April 2010.

Changes the definition of related party to be the same as that in law and provides an exemption only in

respect of wholly-owned subsidiaries, rather than 90% subsidiaries as previously permitted. The

amendments to FRS 8 have been ado

p

ted b

y

the Com

p

an

y

with effect from 1 A

p

ril 2010.

Clarifies the definition of vesting conditions and the accounting treatment of cancellations. Vesting

conditions are defined as either service conditions or performance conditions. Cancellations by

employees are accounted for in the same way as cancellations by the Company.

Amendment to FRS 29 on improving financial

instrument disclosures

Amendment to FRS 20 on group cash settled share

based payments

Contains amendments to various existing standards. The amendments have been adopted by the

Company with effect from 1 April 2010.

Prohibits designating inflation as a hedgeable component of an instrument, unless cash flows relating to

the separate inflation component are contractual and also prohibits the designation of a purchased option

in its entirety as the hedge of a one-sided risk in a forecast transaction. The amendments to FRS 26

have been adopted by the Company with effect from 1 April 2010.

Amendment to FRS 8 on related party disclosures

Sets out disclosure requirements in respect of assets that are held and maintained principally for their

contribution to knowledge and culture. FRS 30 has been adopted by the Company with effect from 1 April

2010.

Amendment to FRS 26 Financial Instruments:

Recognition and measurement on eligible hedged

items

The Company has yet to adopt the following FRS. However, it is not expected to have a material impact on the Company's results or assets

and liabilities.

Addresses the classification as a liability or as equity of certain puttable financial instruments and

instruments, or components thereof, which impose upon an entity an obligation to deliver a pro rata share

of net assets on liquidation. The amendments to FRS 25 have been adopted by the Company with effect

from 1 April 2010.

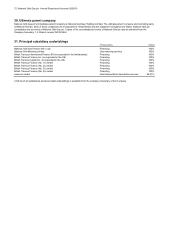

Makes consequential amendments to FRS to reflect provisions of the Companies Act 2006.

Amendments to FRS 26 and UITF 42 on embedded

derivatives

Requires reassessment of whether an embedded derivative should be seperated out if a financial asset

is reclassified out of the fair value through profit or loss category.

Amendment to FRS for Companies Act changes