National Grid 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 National Grid Gas plc Annual Report and Accounts 2009/10

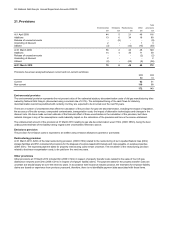

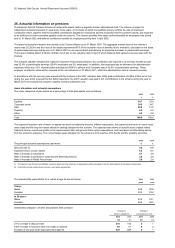

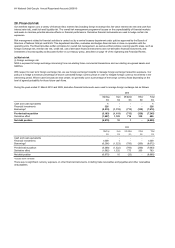

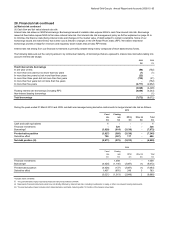

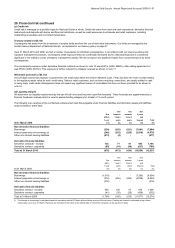

28. Financial risk

(a) Market risk

(i) Foreign exchange risk

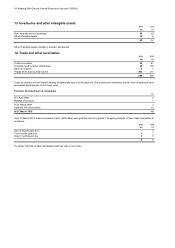

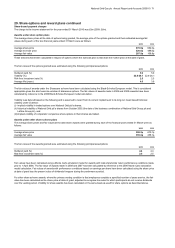

2010

Sterling Euro US dollar Other Total

£m £m £m £m £m

Cash and cash equivalents 1---1

Financial investments 326 - - - 326

Borrowings* (5,510) (1,119) (713) (330) (7,672)

Pre-derivative position (5,183) (1,119) (713) (330) (7,345)

Derivative effect (1,687) 1,129 714 330 486

Net debt position (6,870) 10 1 - (6,859)

2009

Sterling Euro US dollar Other Total

£m £m £m £m £m

Cash and cash equivalents -----

Financial investments 1,008 1 - - 1,009

Borrowings* (6,296) (1,323) (793) (260) (8,672)

Pre-derivative position (5,288) (1,322) (793) (260) (7,663)

Derivative effect (1,582) 1,332 773 260 783

Net debt position (6,870) 10 (20) - (6,880)

*Includes bank overdrafts

During the years ended 31 March 2010 and 2009, derivative financial instruments were used to manage foreign exchange risk as follows:

There was no significant currency exposure on other financial instruments, including trade receivables and payables and other receivables

and payables.

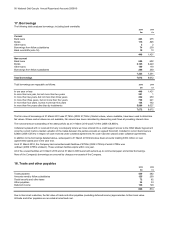

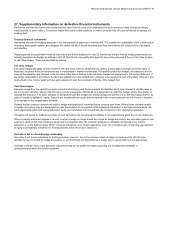

Our activities expose us to a variety of financial risks: market risk (including foreign exchange risk; fair value interest rate risk and cash flow

interest rate risk), credit risk and liquidity risk. The overall risk management programme focuses on the unpredictability of financial markets

and seeks to minimise potential adverse effects on financial performance. Derivative financial instruments are used to hedge certain risk

exposures.

Risk management related to financial activities is carried out by a central treasury department under policies approved by the Boards of

Directors of National Grid plc and NGG. This department identifies, evaluates and hedges financial risks in close co-operation with the

operating units. The Board provides written principles for overall risk management, as well as written policies covering specific areas, such as

foreign exchange risk, interest rate risk, credit risk, use of derivative financial instruments and non-derivative financial instruments, and

investment of excess liquidity as discussed further in our treasury policy, described on page 19 of the Operating and Financial Review.

NGG is exposed to foreign exchange risk arising from non-sterling future commercial transactions and non-sterling recognised assets and

liabilities.

With respect to near term foreign exchange risk, we use foreign exchange forwards to manage foreign exchange transaction exposure. Our

policy is to hedge a minimum percentage of known contracted foreign currency flows in order to mitigate foreign currency movements in the

intervening period. Where cash forecasts are less certain, we generally cover a percentage of the foreign currency flows depending on the

level of agreed probability for those future cash flows.