National Grid 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 67

28. Financial risk continued

(c) Credit risk

Treasury related credit risk

Wholesale and retail credit risk

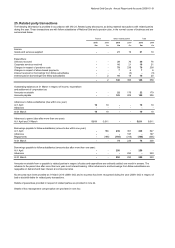

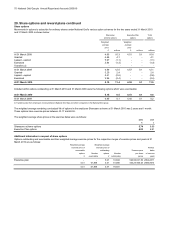

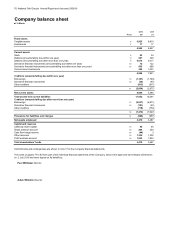

(d) Liquidity analysis

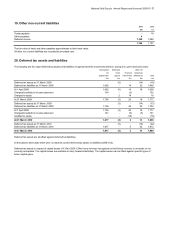

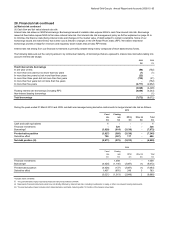

Due Due Due

Due between between 3 years

within 1 and 2 2 and 3 and

1 year years years beyond Total

At 31 March 2010

£m £m £m £m £m

Non-derivative financial liabilities

Borrowing

s

(330) (252) (221) (7,091) (7,894)

Interest payments on borrowings (i) (248) (253) (256) (3,819) (4,576)

Other non-interest bearing liabilities (473) (4) - - (477)

Derivative financial liabilities

Derivative contracts - receipts 135 77 91 893 1,196

Derivative contract - payments (60) (41) (48) (637) (786)

Total at 31 March 2010 (976) (473) (434) (10,654) (12,537)

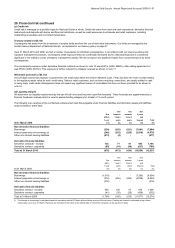

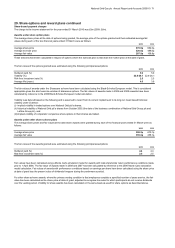

Due Due Due

Due between between 3 years

within 1 and 2 2 and 3 and

1 year years years beyond Total

A

t 31 March 2009

£m £m £m £m £m

Non-derivative financial liabilities

Borrowing

s

(1,519) - - (7,285) (8,804)

Interest payments on borrowings (i) (274) (255) (262) (4,038) (4,829)

Other non-interest bearing liabilities (415) - - - (415)

Derivative financial liabilities

Derivative contract - receipts 450 125 57 674 1,306

Derivative contract - payments (41) (35) (28) (428) (532)

Total at 31 March 2009 (1,799) (165) (233) (11,077) (13,274)

(i)

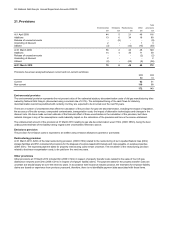

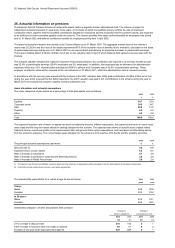

Credit risk is managed on a portfolio basis for National Grid as a whole. Credit risk arises from cash and cash equivalents, derivative financial

instruments and deposits with banks and financial institutions, as well as credit exposures to wholesale and retail customers, including

outstanding receivables and committed transactions.

Our principal commercial exposure is governed by the credit rules within the Uniform Network Code. These lay down the level of credit relative

to the regulatory asset value for each credit rating. Sales to retail customers, such as those requiring connections, are usually settled in cash

or using major credit cards. Management does not expect any significant losses of receivables that have not been provided for as shown in

note 14.

Counterparty risk arises from the investment of surplus funds and from the use of derivative instruments. Our limits are managed by the

central treasury department of National Grid plc, as explained in our treasury policy on page 21.

As at 31 March 2010 and 2009, we had a number of exposures to individual counterparties. In accordance with our treasury policies and

exposure management practices, counterparty credit exposure limits are continually monitored and no individual exposure is considered

significant in the ordinary course of treasury management activity. We do not expect any significant losses from non-performance by these

counterparties.

The counterparty exposure under derivative financial contracts as shown in note 12 was £637m (2009: £892m); after netting agreements it

was £550m (2009: £847m). This exposure is further reduced by collateral received as shown in note 17.

We determine our liquidity requirements by the use of both short and long term cash flow forecasts. These forecasts are supplemented by a

financial headroom analysis which is used to assess funding adequacy for at least a 12 month period.

The following is an analysis of the contractual undiscounted cash flows payable under financial liabilities and derivative assets and liabilities

as at the balance sheet date:

The interest on borrowings is calculated based on borrowings held at 31 March without taking account of future issues. Floating rate interest is estimated using a future

interest rate curve as at 31 March. Payments are included on the basis of the earliest date on which the Company can be required to settle.