National Grid 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2009/10 53

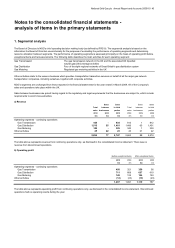

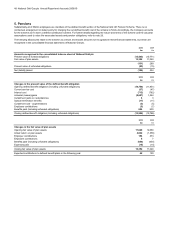

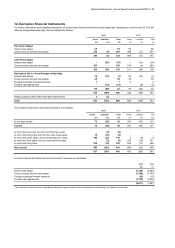

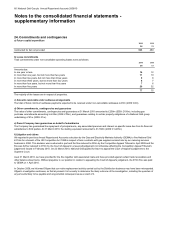

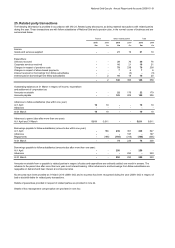

12. Derivative financial instruments

2010 2009

Asset Liabilities Total Asset Liabilities Total

£m £m £m £m £m £m

Fair value hedges

Interest rate swaps 65 - 65 98 - 98

Cross-currency interest rate swaps 275 (6) 269 488 (11) 477

340 (6) 334 586 (11) 575

Cash flow hedges

Interest rate swaps - (55) (55) 1 (31) (30)

Cross-currency interest rate swaps 185 - 185 210 (4) 206

185 (55) 130 211 (35) 176

Derivatives not in a formal hedge relationship

Interest rate swaps 74 (75) (1) 53 (57) (4)

Cross-currency interest rate swaps 35 - 35 39 - 39

Forward exchange forward contract

s

1-13-3

Forward rate agreements - (13) (13) - (6) (6)

110 (88) 22 95 (63) 32

635 (149) 486 892 (109) 783

Hedge positions offset within derivative instruments 2 (2) - ---

Total 637 (151) 486 892 (109) 783

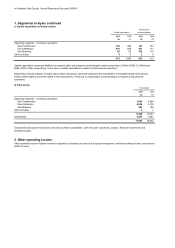

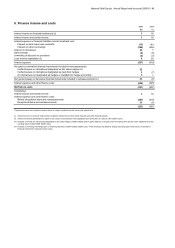

The maturity of derivative financial instruments is as follows:

2010 2009

Assets Liabilities Total Assets Liabilities Total

£m £m £m £m £m £m

In one year or less 72 (30) 42 204 (67) 137

Current 72 (30) 42 204 (67) 137

In more than one year, but not more than two years - (6) (6) ---

In more than two years, but not more than three years 15 (19) (4) ---

In more than three years, but not more than four years 140 (22) 118 5 (6) (1)

In more than four years, but not more than five years - (2) (2) 160 (19) 141

In more than five years 410 (72) 338 523 (17) 506

Non-curren

t

565 (121) 444 688 (42) 646

637 (151) 486 892 (109) 783

2010 2009

£m £m

Interest rate swaps (3,154) (2,924)

Cross-currency interest rate swaps (1,748) (1,707)

Foreign exchange forward contracts (39) (15)

Forward rate agreements (1,730) (3,345)

(6,671) (7,991)

*The notional contract amounts of derivatives indicate the gross nominal value of transactions outstanding at the balance sheet date.

For further information and a detailed description of our derivative financial instruments and hedge type designations, refer to note 27. The fair

value by designated hedge type can be analysed as follows:

For each class of derivative the notional contract* amounts are as follows: