Motorola 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

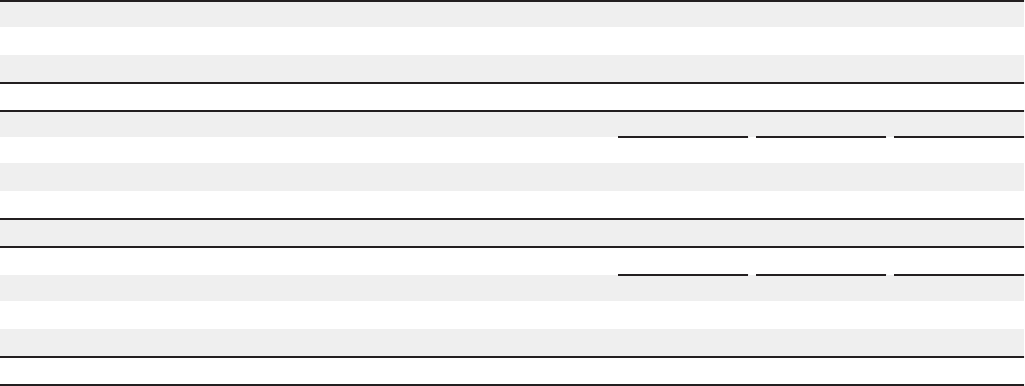

Goodwill

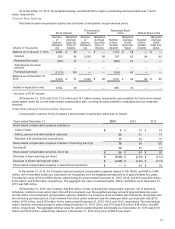

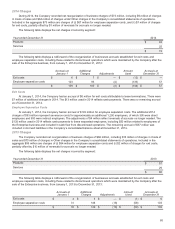

The following table displays a rollforward of the carrying amount of goodwill by segment from January 1, 2014 to

December 31, 2015:

Products Services Total

Balance as of January 1, 2014

Aggregate goodwill acquired $ 249 $ 112 $ 361

Accumulated impairment losses ———

Goodwill, net of impairment losses 249 112 361

Goodwill acquired 15 7 22

Balance as of December 31, 2014

Aggregate goodwill acquired/disposed 264 119 383

Accumulated impairment losses ———

Goodwill, net of impairment losses 264 119 383

Goodwill acquired 63137

Balance as of December 31, 2015

Aggregate goodwill acquired 270 150 420

Accumulated impairment losses ———

Goodwill, net of impairment losses $ 270 $ 150 $ 420

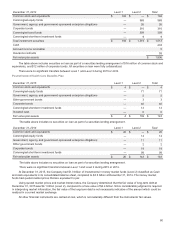

On December 31, 2013, the Company completed the acquisition of a communication software provider in push-to-talk-

over-broadband applications for a gross purchase price of $48 million. As a result of the acquisition, the Company recognized

$22 million of goodwill and $20 million of identifiable intangible assets in 2014 when the purchase accounting was completed.

On November 18, 2014, the Company completed the acquisition of an equipment provider for a purchase price of $22

million. During the nine months ended October 3, 2015, the Company completed the purchase accounting for this acquisition,

recognizing $6 million of goodwill and $12 million of identifiable intangible assets. These identifiable intangible assets were

classified as completed technology to be amortized over five years.

During the year ended December 31, 2015, the Company completed the acquisitions of two providers of public safety

software-based solutions for an aggregate purchase price of $50 million, recognizing an additional $31 million of goodwill, $22

million of identifiable intangible assets, and $3 million of acquired liabilities related to these acquisitions. The $22 million of

identifiable intangible assets were classified as: (i) $11 million completed technology, (ii) $8 million customer-related, and (iii) $3

million of other intangibles. These intangible assets will be amortized over periods ranging from five to ten years.

The results of operations for these acquisitions have been included in the Company’s consolidated statements of

operations subsequent to the acquisition date. The pro forma effects of these acquisitions are not significant individually or in the

aggregate.

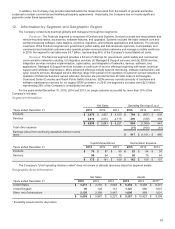

On February 19, 2016, we completed the acquisition of 100% of the equity interest in Guardian Digital Communications

Limited ("GDCL"), a holding company of Airwave Solutions Limited ("Airwave"), the largest private operator of a public safety

network in the world. For the purposes of purchase accounting, the net purchase price was $1.1 billion, taking into account

approximately $1 billion of net cash paid at closing and approximately $90 million of deferred consideration which will be due

on November 15, 2018. The acquisition of Airwave enables the Company to grow revenue and geographically diversify its global

Managed & Support services offerings within its Services segment, while offering a proven service delivery platform to build on

for providing innovative, leading, mission-critical communications solutions and services to customers. As of the date of issuance

of the Company's financial statements, the purchase accounting has not been completed.

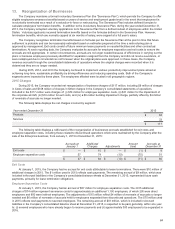

The Company conducts its annual assessment of goodwill for impairment in the fourth quarter of each year. The goodwill

impairment assessment is performed at the reporting unit level. A reporting unit is an operating segment or one level below an

operating segment. The Company has determined that the Products segment and Services segment each meet the definition of

a reporting unit.

The Company performed a qualitative assessment to determine whether it was more-likely-than-not that the fair value of

each reporting unit was less than its carrying amount for the fiscal years 2015, 2014, and 2013. In performing this qualitative

assessment the Company assessed relevant events and circumstances including macroeconomic conditions, industry and

market conditions, cost factors, overall financial performance, changes in share price, and entity-specific events. For fiscal years

2015, 2014, and 2013, the Company concluded it was more-likely-than-not that the fair value of each reporting unit exceeded its

carrying value. Therefore, the two-step goodwill impairment test was not required and there was no impairment of goodwill.