Motorola 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

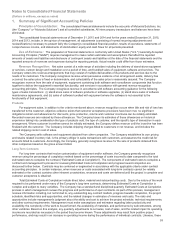

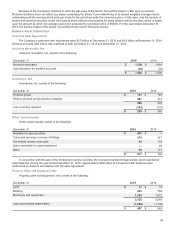

Cash Equivalents: The Company considers all highly-liquid investments purchased with an original maturity of three

months or less to be cash equivalents. Restricted cash was $63 million at both December 31, 2015 and December 31, 2014.

Investments: Investments in equity and debt securities classified as available-for-sale are carried at fair value. When

applicable, debt securities classified as held-to-maturity are carried at amortized cost. Equity securities that are restricted for

more than one year or that are not publicly traded are carried at cost. Certain investments are accounted for using the equity

method if the Company has significant influence over the issuing entity.

The Company assesses declines in the fair value of investments to determine whether such declines are other-than-

temporary. This assessment is made considering all available evidence, including changes in general market conditions, specific

industry and individual company data, the length of time and the extent to which the fair value has been less than cost, the

financial condition and the near-term prospects of the entity issuing the security, and the Company’s ability and intent to hold the

investment until recovery. Other-than-temporary impairments of investments are recorded to Other within Other income

(expense) in the Company’s consolidated statements of operations in the period in which they become impaired.

Inventories: Inventories are valued at the lower of average cost (which approximates cost on a first-in, first-out basis)

or market (net realizable value or replacement cost).

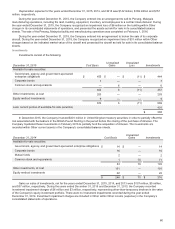

Property, Plant and Equipment: Property, plant and equipment are stated at cost less accumulated depreciation.

Depreciation is recorded on a straight-line basis, based on the estimated useful lives of the assets (buildings and building

equipment, five to forty years; machinery and equipment, two to ten years) and commences once the assets are ready for their

intended use.

Goodwill and Intangible Assets: Goodwill is assessed for impairment at least annually at the reporting unit level.

The Company performs its annual assessment of goodwill for impairment in the fourth quarter of each fiscal year. The annual

assessment is performed using the two-step goodwill test which may also include the optional qualitative assessment to

determine whether it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount prior to

performing the two-step goodwill impairment test. If this is the case, the two-step goodwill impairment test is required. If it is

more-likely-than-not that the fair value of a reporting unit is greater than its carrying amount, the two-step goodwill impairment

test is not required.

If the two-step goodwill impairment test is performed, first, the fair value of each reporting unit is compared to its book

value. Second, if the fair value of the reporting unit is less than its book value, the Company performs a hypothetical purchase

price allocation based on the reporting unit's fair value to determine the fair value of the reporting unit's goodwill. Fair value is

determined using a combination of present value techniques and market prices of comparable businesses.

Intangible assets are amortized on a straight line basis over their respective estimated useful lives ranging from one to ten

years. The Company has no intangible assets with indefinite useful lives.

Impairment of Long-Lived Assets: Long-lived assets, which include intangible assets, held and used by the

Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of assets

may not be recoverable. The Company evaluates recoverability of assets to be held and used by comparing the carrying amount

of an asset (group) to future net undiscounted cash flows to be generated by the asset (group). If an asset (group) is considered

to be impaired, the impairment to be recognized is equal to the amount by which the carrying amount of the asset (group)

exceeds the asset's (group's) fair value calculated using a discounted future cash flows analysis or market comparables. Assets

held for sale, if any, are reported at the lower of the carrying amount or fair value less cost to sell.

Income Taxes: The Company records deferred income tax assets and liabilities based on the estimated future tax

effects of differences between the financial and tax bases of assets and liabilities based on currently enacted tax laws. The

Company's deferred and other tax balances are based on management's interpretation of the tax regulations and rulings in

numerous tax jurisdictions. Income tax expense and liabilities recognized by the Company also reflect its best estimates and

assumptions regarding, among other things, the level of future taxable income, the effect of the Company's various tax planning

strategies, and uncertain tax positions. Future tax authority rulings and changes in tax laws, changes in projected levels of

taxable income, and future tax planning strategies could affect the actual effective tax rate and tax balances recorded by the

Company.

Sales and Use Taxes: The Company records taxes imposed on revenue-producing transactions, including sales,

use, value added and excise taxes, on a net basis with such taxes excluded from revenue.

Long-term Receivables: Long-term receivables include trade receivables where contractual terms of the note

agreement are greater than one year. Long-term receivables are considered impaired when management determines collection

of all amounts due according to the contractual terms of the note agreement, including principal and interest, is no longer

probable. Impaired long-term receivables are valued based on the present value of expected future cash flows discounted at the

receivable’s effective interest rate, or the fair value of the collateral if the receivable is collateral dependent. Interest income and

late fees on impaired long-term receivables are recognized only when payments are received. Previously impaired long-term

receivables are no longer considered impaired and are reclassified to performing when they have performed under a workout or

restructuring for four consecutive quarters.

Foreign Currency: Certain of the Company’s non-U.S. operations use their respective local currency as their

functional currency. Those operations that do not have the U.S. dollar as their functional currency translate assets and liabilities

at current rates of exchange in effect at the balance sheet date and revenues and expenses using rates that approximate those