Motorola 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

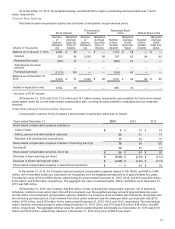

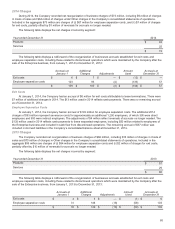

Exit Costs

At January 1, 2013, the Company had an accrual of $4 million for exit costs attributable to lease terminations. There were

$3 million of additional charges in 2013. The $1 million used in 2013 reflects cash payments. The remaining accrual of $6 million,

which was included in Accrued liabilities in the Company’s consolidated balance sheets at December 31, 2013, represented

future cash payments, primarily for lease termination obligations.

Employee Separation Costs

At January 1, 2013, the Company had an accrual of $31 million for employee separation costs, representing the severance

costs for approximately 400 employees. The additional 2013 charges of $146 million represent severance costs for

approximately an additional 2,200 employees, of which 800 were direct employees and 1,400 were indirect employees. The

adjustments of $16 million reflect accruals no longer required. The $58 million used in 2013 reflects cash payments to these

separated employees, including $20 million related to employees of the Enterprise business and included in cash flow from

discontinued operations. The remaining accrual of $103 million was included in Accrued liabilities in the Company’s consolidated

balance sheet at December 31, 2013.

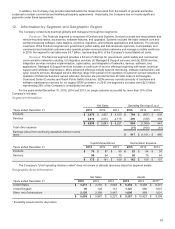

14. Intangible Assets and Goodwill

The Company accounts for acquisitions using purchase accounting with the results of operations for each acquiree

included in the Company’s consolidated financial statements for the period subsequent to the date of acquisition. The pro forma

effects of the acquisitions completed in 2015, 2014, and 2013 were not significant individually or in the aggregate. The Company

did not have any significant acquisitions during the years ended December 31, 2015, 2014, and 2013.

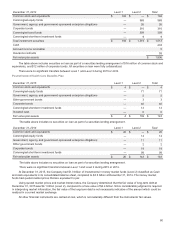

Intangible Assets

Amortized intangible assets are comprised of the following:

2015 2014

December 31

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Intangible assets:

Completed technology $60$32$37$27

Patents 8584

Customer-related 23 10 15 8

Other intangibles 20 15 17 15

$ 111 $ 62 $77$54

Amortization expense on intangible assets, which is included within Other charges in the consolidated statements of

operations, was $8 million, $4 million, and $1 million for the years ended December 31, 2015, 2014, and 2013, respectively. As

of December 31, 2015, future amortization expense is estimated to be $9 million in 2016 and 2017, $8 million in 2018, and $7

million in 2019, and $4 million in 2020.

Amortized intangible assets, excluding goodwill, were comprised of the following by segment:

2015 2014

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Products $89$60$77$54

Services 22 2 ——

$ 111 $ 62 $77$54