Motorola 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

Company’s global tax disputes could have a material adverse effect on the Company’s consolidated financial position, liquidity,

or results of operations in the periods, and as of the dates, on which the matters are ultimately resolved.

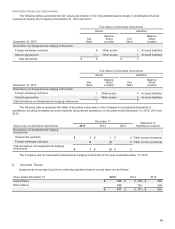

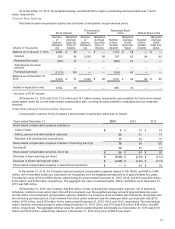

Based on the potential outcome of the Company’s global tax examinations, the expiration of the statute of limitations for

specific jurisdictions, or the continued ability to satisfy tax incentive obligations, it is reasonably possible that the unrecognized

tax benefits will change within the next twelve months. The associated net tax impact on the effective tax rate, exclusive of

valuation allowance changes, is estimated to be in the range of a $50 million tax charge to a $50 million tax benefit, with cash

payments not to exceed $30 million.

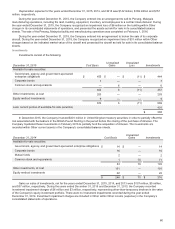

At December 31, 2015, the Company had $29 million accrued for interest and $24 million accrued for penalties on

unrecognized tax benefits. At December 31, 2014, the Company had $26 million and $26 million accrued for interest and

penalties, respectively, on unrecognized tax benefits.

7. Retirement Benefits

Pension and Postretirement Health Care Benefits Plans

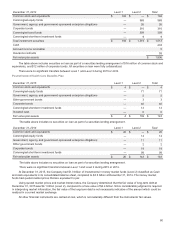

U.S. Pension Benefit Plans

The Company’s noncontributory U.S. pension plan (the “Regular Pension Plan”) provides benefits to U.S. employees hired

prior to January 1, 2005, who became eligible after one year of service. In December 2008, the Company amended the Regular

Pension Plan such that, effective March 1, 2009: (i) no participant shall accrue any benefit or additional benefit on or after

March 1, 2009, and (ii) no compensation increases earned by a participant on or after March 1, 2009 shall be used to compute

any accrued benefit.

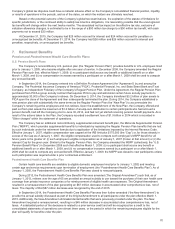

In September 2014, the Company entered into a Definitive Purchase Agreement (the “Agreement”) by and among the

Company, The Prudential Insurance Company of America (“PICA”), Prudential Financial, Inc. and State Street Bank and Trust

Company, as Independent Fiduciary of the Company’s Regular Pension Plan. Under the Agreement, the Regular Pension Plan

purchased from PICA a group annuity contract that requires PICA to pay and administer certain future annuity payments to

approximately 30,000 of the Company’s retirees. On December 3, 2014, the Company transfered $3.2 billion of plan assets to

PICA upon the close of the Agreement and then subsequently terminated the plan. During 2014, the Company established a

new pension plan with substantially the same terms as the Regular Pension Plan (the “New Plan”) to accommodate the

Company's remaining active employees and non-retirees. Upon the establishment of the New Plan, the Company offered and

paid out from plan assets the maximum of $1.0 billion of a lump-sum distribution to certain participants who had accrued a

pension benefit, had left the Company prior to June 30, 2014, and had not yet started receiving pension benefit payments. As a

result of the actions taken to the Plan, the Company recorded a settlement loss of $1.9 billion in 2014 which is recorded in

"Other charges" within the statement of operations.

The Company has an additional noncontributory supplemental retirement benefit plan, the Motorola Supplemental Pension

Plan (“MSPP”), which provides supplemental benefits to individuals by replacing the Regular Pension Plan benefits that are lost

by such individuals under the retirement formula due to application of the limitations imposed by the Internal Revenue Code.

Effective January 1, 2007, eligible compensation was capped at the IRS limit plus $175,000 (the “Cap”) or, for those already in

excess of the Cap as of January 1, 2007, the eligible compensation used to compute such employee’s MSPP benefit for all

future years is the greater of: (i) such employee’s eligible compensation as of January 1, 2007 (frozen at that amount) or (ii) the

relevant Cap for the given year. Similar to the Regular Pension Plan, the Company amended the MSPP (collectively, the “U.S.

Pension Benefit Plans”) in December 2008 such that effective March 1, 2009: (i) no participant shall accrue any benefit or

additional benefit on or after March 1, 2009, and (ii) no compensation increases earned by a participant on or after March 1,

2009 shall be used to compute any accrued benefit. Effective January 1, 2009, the MSPP was closed to new participants unless

such participation was required under a prior contractual entitlement.

Postretirement Health Care Benefits Plan

Certain health care benefits are available to eligible domestic employees hired prior to January 1, 2002 and meeting

certain age and service requirements upon termination of employment (the “Postretirement Health Care Benefits Plan”). As of

January 1, 2005, the Postretirement Health Care Benefits Plan was closed to new participants.

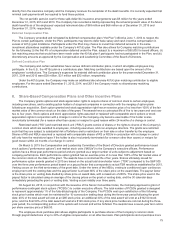

During 2012, the Postretirement Health Care Benefits Plan was amended ("the Original Amendment") such that, as of

January 1, 2013, retirees over the age of 65 are provided an annual subsidy to use toward the purchase of their own health care

coverage from private insurance companies or for reimbursement of eligible health care expenses. The Original Amendment

resulted in a remeasurement of the plan generating an $87 million decrease in accumulated other comprehensive loss, net of

taxes. The majority of that $87 million decrease was recognized by the end of 2015.

In September 2014, the Postretirement Health Care Benefits Plan was then further amended (“the New Amendment”) to

provide the annual subsidy discussed as part of the Original Amendment to all participants under the plan effective March 1,

2015. Additionally, the New Amendment eliminated dental benefits that were previously provided under the plan. The New

Amendment required a remeasurement, resulting in a $45 million decrease in accumulated other comprehensive loss, net of

taxes. A substantial portion of the decrease is related to a prior service credit and will be recognized as a credit to the

consolidated statements of operations over almost three years, or the period in which the remaining employees eligible for the

plan will qualify for benefits under the plan.