Motorola 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

not that the fair value of each reporting unit was less than its carrying amount for the fiscal years 2015, 2014, and 2013. In

performing this qualitative assessment we assessed relevant events and circumstances including macroeconomic conditions,

industry and market conditions, cost factors, overall financial performance, changes in share price, and entity-specific events.

For fiscal years 2015, 2014, and 2013, we concluded it was more-likely-than-not that the fair value of each reporting unit

exceeded its carrying value.

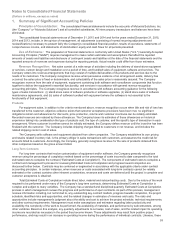

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No.

2014-09, "Revenue from Contracts with Customers." This new standard will replace most existing revenue recognition guidance

in U.S. GAAP. The core principle of the ASU is that an entity should recognize revenue for the transfer of goods or services

equal to the amount it expects to receive for those goods and services. The ASU requires additional disclosure about the nature,

amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and

estimates and changes in those estimates. In August 2015, the FASB issued ASU 2015-14, "Revenue from Contracts with

Customers: Deferral of the Effective Date" that delayed the effective date of ASU 2014-09 by one year to January 1, 2018, as the

our annual reporting period begins after December 15, 2017. ASU 2014-09 allows for both retrospective and modified

retrospective methods of adoption. We are in the process of determining the method of adoption we will elect and are currently

assessing the impact of this ASU on our consolidated financial statements and footnote disclosures.

In April 2015, the FASB issued ASU No. 2015-03, "Interest-Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs." Under this guidance, debt issuance costs related to a recognized debt liability are

required to be presented in the balance sheet as a direct reduction from the carrying amount of such debt liability, consistent with

debt discounts. The recognition and measurement guidance for debt issuance costs are not affected by this guidance. In

adopting the ASU, we will be required to apply a full retrospective approach to all periods presented. This guidance will be

effective January 1, 2016 and, upon adoption, debt issuance costs capitalized in other assets in the consolidated balance sheet

will be reclassified and presented as a reduction to long-term debt. As of December 31, 2015, debt issuance costs, net of

accumulated amortization, recognized in the consolidated balance sheet were $41 million.

In November 2015, the FASB issued ASU 2015-17 “Balance Sheet Classification of Deferred Taxes” (ASU 2015-17). ASU

2015-17 simplifies current guidance, which requires entities to separately present deferred tax assets and deferred tax liabilities

as current and noncurrent in a classified balance sheet. ASU 2015-17 is effective for the Company’s fiscal year 2017, however,

early adoption is allowed. We have adopted the standard on a prospective basis as of December 31, 2015. Prior period amounts

have not been adjusted to reflect this presentation. The standard reduces the complexity in the preparation of the income tax

provision and simplifies the presentation of the deferred taxes in our consolidated balance sheet.

Forward-Looking Statements

Except for historical matters, the matters discussed in this Form 10-K are forward-looking statements within the meaning of

applicable federal securities law. These statements are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and generally include words such as “believes,” “expects,” “intends,” “aims,” “estimates” and

similar expressions. We can give no assurance that any future results or events discussed in these statements will be achieved.

Any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as

of any subsequent date. Readers are cautioned that such forward-looking statements are subject to a variety of risks and

uncertainties that could cause our actual results to differ materially from the statements contained in this Form 10-K. Forward-

looking statements include, but are not limited to, statements under the following headings: (1) “Business,” about: (a) industry

growth and demand, including opportunities resulting from such growth, (b) future product development and the demand for new

products, (c) customer spending, (d) the impact of our strategy and focus areas, (e) the impact from the loss of key customers,

(f) competitive position and our ability to maintain a leadership position in our core products, (g) increased competition, (h) the

impact of regulatory matters, (i) the impact from the allocation and regulation of spectrum, particularly with respect to broadband

spectrum, (j) the firmness of each segment's backlog, (k) the competitiveness of the patent portfolio, (l) the impact of research

and development, (m) the availability of materials and components, energy supplies and labor, and (n) the seasonality of the

business; (2) “Properties,” about the sufficiency of our manufacturing capacity and the consequences of a disruption in

manufacturing; (3) “Legal Proceedings,” about the ultimate disposition of pending legal matters and timing; (4) “Management's

Discussion and Analysis,” about: (a) the impact of the Airwave acquisition on our business, (b) the benefits of the relationship

with Silver Lake Partners, (c) the expected efficiencies of reorganizing our R&D and SG&A functions, (d) market growth/

contraction, demand, spending and resulting opportunities, (e) impact of foreign exchange rate fluctuations, (f) our continued

ability to reduce our operating expenses, (g) the growth of our Services segment and the resulting impact on consolidated gross

margin, (h) the increase in public safety LTE revenues, (i) the decline in iDEN, (j) the return of capital to shareholders through

dividends and/or repurchasing shares, (k) our ability to invest in capital expenditures and R&D, (l) the success of our business

strategy and portfolio, (m) future payments, charges, use of accruals and expected cost-saving and profitability benefits

associated with our reorganization of business programs and employee separation costs, (n) our ability and cost to repatriate

funds, (o) future cash contributions to pension plans or retiree health benefit plans, (p) the liquidity of our investments, (q) our

ability and cost to access the capital markets, (r) our ability to borrow and the amount available under our credit facilities, (s) our

ability to settle the principal amount of the Senior Convertible Notes in cash, (t) our ability and cost to obtain Performance Bonds,

(u) adequacy of internal resources to fund expected working capital and capital expenditure measurements, (v) expected

payments pursuant to commitments under long-term agreements, (w) the ability to meet minimum purchase obligations, (x) our

ability to sell accounts receivable and the terms and amounts of such sales, (y) the outcome and effect of ongoing and future

legal proceedings, (z) the impact of the loss of key customers, and (aa) the expected effective tax rate and deductibility of certain

items; and (5) “Quantitative and Qualitative Disclosures about Market Risk,” about: (a) the impact of foreign currency exchange