Motorola 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

the standard on a prospective basis as of December 31, 2015. Prior period amounts have not been adjusted to reflect this

presentation. The standard reduces the complexity in the preparation of the income tax provision and simplifies the presentation

of the deferred taxes in our consolidated balance sheet.

2. Discontinued Operations

On October 27, 2014, the Company completed the sale of its Enterprise business to Zebra Technologies Corporation

("Zebra") for $3.45 billion in cash. Certain assets of the Enterprise business were excluded from the transaction and retained by

the Company, including the Company’s iDEN business. The historical financial results of the Enterprise business, excluding

those assets and liabilities retained in the transaction, are reflected in the Company's consolidated financial statements and

footnotes as discontinued operations for all periods presented.

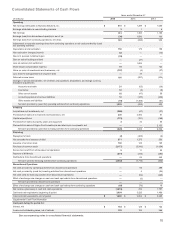

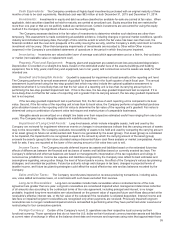

The following table displays summarized activity in the Company’s consolidated statements of operations for discontinued

operations during the years ended December 31, 2015, 2014, and 2013.

Years ended December 31 2015 2014 2013

Net sales $—$1,904$2,469

Operating earnings —203 268

Gains (losses) on sales of investments and businesses, net (24) 1,888 3

Earnings (loss) before income taxes (24) 2,074 266

Income tax expense 678 100

Earnings (loss) from discontinued operations, net of tax (30) 1,996 166

During the year ended December 31, 2015, the Company recorded adjustments to the gain on the sale of the Enterprise

business, including additional tax expense on the sale of the Enterprise business to reflect actual amounts filed in the income tax

return. During the year ended December 31, 2015, the Company also settled the working capital true-up with Zebra for $12

million.

3. Other Financial Data

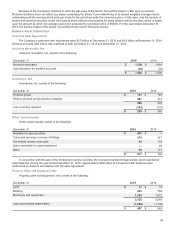

Statement of Operations Information

Other Charges (Income)

Other charges (income) included in Operating earnings (loss) consist of the following:

Years ended December 31 2015 2014 2013

Other charges (income):

Intangibles amortization $8$4$1

Reorganization of businesses 77 64 70

Legal settlement —8—

Non-U.S. pension curtailment gain (32) ——

Settlement of pension plan —1,917 —

Impairment of corporate aircraft 31 ——

Gain on sale of building and land —(21) —

$84$1,972$ 71