Motorola 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

are approximately $246 million over the remaining life of the contracts; however, these contracts can be terminated. Termination

would result in a penalty substantially less than the remaining annual contract payments. We would also be required to find

another source for these services, including the possibility of performing them in-house.

As is customary in bidding for and completing certain projects and pursuant to a practice we have followed for many years,

we have a number of performance/bid bonds, standby letters of credit and surety bonds outstanding (collectively, referred to as

“Performance Bonds”), primarily relating to projects with our government customers. These Performance Bonds normally have

maturities of multiple years and are standard in the industry as a way to give customers a convenient mechanism to seek

resolution if a contractor does not satisfy certain requirements under a contract. Typically, a customer can draw on the

Performance Bond only if we do not fulfill all terms of a project contract. If such an occasion occurred, we would be obligated to

reimburse the institution that issued the Performance Bond for the amounts paid. In our long history, it has been rare for us to

have a Performance Bond drawn upon. At December 31, 2015, outstanding Performance Bonds totaled approximately $1.8

billion, compared to $1.6 billion at December 31, 2014. Any future disruptions, uncertainty, or volatility in bank, insurance or

capital markets, or a change in our credit ratings could adversely affect our ability to obtain Performance Bonds and may result

in higher funding costs to obtain such Performance Bonds.

Off-Balance Sheet Arrangements: At December 31, 2015, we had no significant off-balance sheet arrangements other

than operating leases and guarantees to third parties as described in Note 11 to the consolidated financial statements and our

obligation to settle the embedded conversion option under the Senior Convertible Notes described in Note 4 to the consolidated

financial statements.

Long-term Customer Financing Commitments

Outstanding Commitments: Certain purchasers of our products and services may request that we provide long-term

financing (defined as financing with a term of greater than one year) in connection with the sale of equipment. These requests

may include all or a portion of the purchase price of the products and services. Our obligation to provide long-term financing may

be conditioned on the issuance of a letter of credit in favor of us by a reputable bank to support the purchaser's credit or a pre-

existing commitment from a reputable bank to purchase the long-term receivables from us. We had outstanding commitments to

provide long-term financing to third-parties totaling $112 million at December 31, 2015, compared to $293 million at

December 31, 2014. Outstanding commitments decreased during 2015 primarily as a result of two large customer contracts, one

of which was converted to an order without long-term financing and the other where the financing commitment was funded and

sold.

Outstanding Long-Term Receivables: We had net non-current long-term receivables of $47 million at December 31,

2015, compared to $31 million at December 31, 2014. There were $1 million of allowances for losses in 2015 and $14 million of

allowances for losses in 2014. These long-term receivables are generally interest bearing, with interest rates ranging from 0% to

13%.

Sales of Receivables

From time to time, we sell accounts receivable and long-term receivables to third-parties under one-time arrangements.

We may or may not retain the obligation to service the sold accounts receivable and long-term receivables. Servicing obligations

are limited to collection activities for sold accounts receivables and long-term receivables.

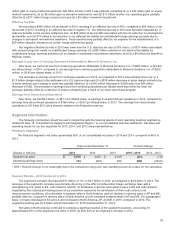

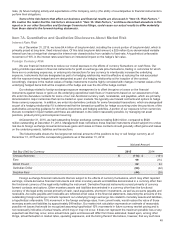

The following table summarizes the proceeds received from sales of accounts receivable and long-term receivables for the

years ended December 31, 2015, 2014, and 2013:

Years ended December 31 2015 2014 2013

Accounts receivable sales proceeds $29$50$14

Long-term receivables sales proceeds 196 124 131

Total proceeds from receivable sales $ 225 $ 174 $ 145

At December 31, 2015, the Company had retained servicing obligations for $668 million of long-term receivables,

compared to $496 million of long-term receivables at December 31, 2014.

Adequate Internal Funding Resources

We believe that we have adequate internal resources available to fund expected working capital and capital expenditure

requirements for the next twelve months as supported by the level of cash and cash equivalents in the U.S. and the ability to

repatriate funds from foreign jurisdictions.

Other Contingencies

Potential Contractual Damage Claims in Excess of Underlying Contract Value: In certain circumstances, our

businesses may enter into contracts with customers pursuant to which the damages that could be claimed by the customer for

failed performance might exceed the revenue we receive from the contract. Contracts with these types of uncapped damages

provisions are fairly rare, but individual contracts could still represent meaningful risk. There is a possibility that a claim by a

customer to one of these contracts could result in expenses that are far in excess of the revenue received in connection with the

contract.