Motorola 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

Actuarial Assumptions

Certain actuarial assumptions such as the discount rate and the long-term rate of return on plan assets have a significant

effect on the amounts reported for net periodic cost and the benefit obligation. The assumed discount rates reflect the prevailing

market rates of a universe of high-quality, non-callable, corporate bonds currently available that, if the obligation were settled at

the measurement date, would provide the necessary future cash flows to pay the benefit obligation when due. The long-term

rates of return on plan assets represent an estimate of long-term returns on an investment portfolio consisting of a mixture of

equities, fixed income, cash and other investments similar to the actual investment mix. In determining the long-term return on

plan assets, the Company considers long-term rates of return on the asset classes (both historical and forecasted) in which the

Company expects the plan funds to be invested.

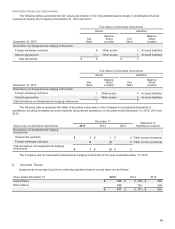

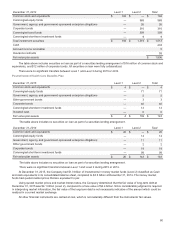

Weighted average actuarial assumptions used to determine costs for the plans at the beginning of the fiscal year were as

follows:

U.S. Pension Benefit

Plans

Non U.S. Pension

Benefit Plans

Postretirement

Health Care Benefits

Plan

2015 2014 2015 2014 2015 2014

Discount rate 4.30% 5.15% 3.19% 4.24% 3.90% 4.65%

Investment return assumption 7.00% 7.00% 5.90% 5.92% 7.00% 7.00%

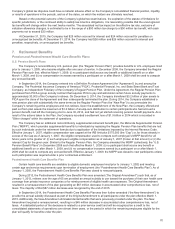

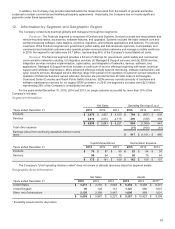

Weighted average actuarial assumptions used to determine benefit obligations for the plans were as follows:

U.S. Pension Benefit

Plans

Non U.S. Pension

Benefit Plans

Postretirement

Health Care Benefits

Plan

2015 2014 2015 2014 2015 2014

Discount rate 4.73% 4.30% 3.57% 3.19% 4.26% 3.90%

Future compensation increase rate n/a n/a 0.41% 2.54% n/a n/a

The accumulated benefit obligations for the plans were as follows:

U.S. Pension Benefit

Plans

Non U.S. Pension

Benefit Plans

December 31 2015 2014 2015 2014

Accumulated benefit obligation $4,304$ 4,536 $ 1,809 $ 2,059

In 2014, the Society of Actuaries ("SOA") released the “RP-2014 White Collar” mortality table which was utilized in

calculating the 2014 projected benefit obligation. During 2015, the SOA issued an update, Mortality Improvement Scale

MP-2015, which includes two additional years of mortality data and was utilized to calculate the 2015 projected benefit

obligation.

Effective on January 1, 2016, the Company changed the method used to estimate the interest and service cost

components of net periodic cost for defined benefit pension and other post-retirement benefit plans. Historically, the interest and

service cost components were estimated using a single weighted-average discount rate derived from the yield curve used to

measure the projected benefit obligation at the beginning of the period. The Company has elected to use a full yield curve

approach in the estimation of these components of net periodic cost by applying the specific spot rates along the yield curve

used in the determination of the projected benefit obligation to the relevant projected cash flows. The Company made this

change to improve the correlation between projected benefit cash flows and the corresponding yield curve spot rates and to

provide a more precise measurement of interest and service costs. This change does not affect the measurement of total benefit

obligations as the change in interest and service cost is completely offset in the actuarial loss reported in the period. The

Company has concluded that this change is a change in estimate and, accordingly, will account for it prospectively beginning in

2016.