Motorola 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

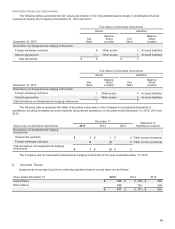

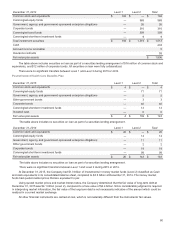

The status of the Company’s plans is as follows:

U.S. Pension Benefit

Plans

Non U.S. Pension

Benefit Plans

Postretirement

Health Care Benefits

Plan

2015 2014 2015 2014 2015 2014

Change in benefit obligation:

Benefit obligation at January 1 $4,536$7,317$2,075$1,904$212$278

Service cost ——12 15 12

Interest cost 193 370 66 80 810

Plan amendments ——1——(41)

Settlements/curtailments —(4,227) (5) ———

Actuarial loss (gain) (319) 1,357 (151) 263 (12) (14)

Foreign exchange valuation adjustment ——(123) (146) ——

Employee contributions ——22——

Benefit payments (106) (281) (62) (43) (17) (23)

Benefit obligation at December 31 4,304 4,536 1,815 2,075 192 212

Change in plan assets:

Fair value at January 1 3,317 6,071 1,806 1,513 163 161

Return on plan assets (84) 642 33 191 (6) 21

Company contributions 31,112 10 237 ——

Settlements —(3,196) ————

Employee contributions ——22——

Foreign exchange valuation adjustment ——(93) (96) ——

Lump sum settlements —(1,031) ————

Benefit payments (106) (281) (62) (41) (14) (19)

Fair value at December 31 3,130 3,317 1,696 1,806 143 163

Funded status of the plan (1,174) (1,219) (119) (269) (49) (49)

Unrecognized net loss 1,777 1,846 453 593 104 109

Unrecognized prior service benefit ———(35) (24) (83)

Prepaid (accrued) pension cost $ 603 $ 627 $ 334 $ 289 $31$(23)

Components of prepaid (accrued) pension cost:

Non-current benefit liability $ (1,174) $ (1,219) $(119)$(269)$(49)$(49)

Deferred income taxes 657 701 46 51 31 10

Accumulated other comprehensive loss 1,120 1,145 407 507 49 16

Prepaid (accrued) pension cost $ 603 $ 627 $ 334 $ 289 $31$(23)

The net funded status of the of the Non U.S. Pension Benefit Plans primarily reflects a net underfunded status of $224

million related to Germany and a net overfunded status of $105 million related to the United Kingdom as of December 31, 2015.

The benefit obligation and plan assets for the Company's plans are measured as of December 31, 2015. The Company

utilizes a five-year, market-related asset value method of recognizing asset related gains and losses.

Under relevant accounting rules, when almost all of the plan participants are considered inactive, the amortization period

for certain unrecognized losses changes from the average remaining service period to the average remaining lifetime of the

participants. As such, depending on the specific plan, the Company amortizes gains and losses over periods ranging from

eleven to thirty-five years. Prior service costs are amortized over periods ranging from two to nine years. Benefits under all

pension plans are valued based on the projected unit credit cost method.

The net periodic cost for 2016 will include amortization of the unrecognized net loss and prior service costs for the U.S.

Pension Benefit Plans and Non U.S. Pension Benefit Plans, currently included in Accumulated other comprehensive loss, of $38

million and $11 million, respectively. It is estimated that the 2016 net periodic expense for the Postretirement Health Care

Benefits Plan will include amortization of a net credit of $16 million, comprised of the unrecognized prior service gain and

unrecognized actuarial loss, currently included in Accumulated other comprehensive loss.