Motorola 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

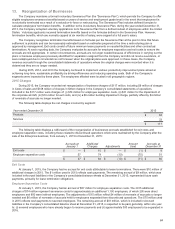

10. Long-term Customer Financing and Sales of Receivables

Long-term Customer Financing

Long-term receivables consist of trade receivables with payment terms greater than twelve months, long-term loans and

lease receivables under sales-type leases. Long-term receivables consist of the following:

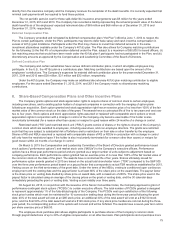

December 31 2015 2014

Long-term receivables $60$49

Less current portion (13) (18)

Non-current long-term receivables, net $47$31

The current portion of long-term receivables is included in Accounts receivable and the non-current portion of long-term

receivables is included in Other assets in the Company’s consolidated balance sheets. There was $2 million of interest income

recognized on long-term receivables for the year ended December 31, 2015. There was $1 million of interest income recognized

on long-term receivables for the year ended 2014 and no interest income recognized on long-term receivables for the year

ended 2013.

Certain purchasers of the Company's products and services may request that the Company provide long-term financing

(defined as financing with a term greater than one year) in connection with the sale of products and services. These requests

may include all or a portion of the purchase price of the products and services. The Company's obligation to provide long-term

financing may be conditioned on the issuance of a letter of credit in favor of the Company by a reputable bank to support the

purchaser's credit or a pre-existing commitment from a reputable bank to purchase the long-term receivables from the Company.

The Company had outstanding commitments to provide long-term financing to third-parties totaling $112 million at December 31,

2015, compared to $293 million at December 31, 2014. Outstanding commitments decreased during the year ended

December 31, 2015 primarily as a result of two large customer contracts, one of which was converted to an order without long-

term financing and the other where the financing commitment was funded and sold.

Sales of Receivables

From time to time, the Company sells accounts receivable and long-term receivables to third-parties under one-time

arrangements. The Company may or may not retain the obligation to service the sold accounts receivable and long-term

receivables.

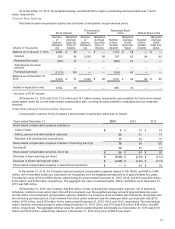

The following table summarizes the proceeds received from sales of accounts receivable and long-term receivables for the

years ended December 31, 2015, 2014 and 2013.

Years ended December 31 2015 2014 2013

Cumulative annual proceeds received from sales:

Accounts receivable sales proceeds $29$50$14

Long-term receivables sales proceeds 196 124 131

Total proceeds from receivable sales $ 225 $ 174 $ 145

At December 31, 2015, the Company had retained servicing obligations for $668 million of long-term receivables,

compared to $496 million of long-term receivables at December 31, 2014. Servicing obligations are limited to collection activities

of sold accounts receivables and long-term receivables.

Credit Quality of Customer Financing Receivables and Allowance for Credit Losses

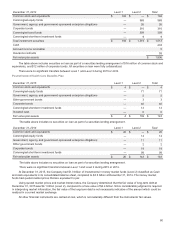

An aging analysis of financing receivables at December 31, 2015 and December 31, 2014 is as follows:

December 31, 2015

Total

Long-term

Receivable

Current Billed

Due

Past Due Under

90 Days

Past Due Over

90 Days

Municipal leases secured tax exempt $ 35$ —$ —$ —

Commercial loans and leases secured 25111

Total gross long-term receivables, including

current portion $ 60$ 1$ 1$ 1