Motorola 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

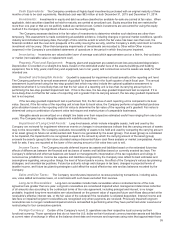

Depreciation expense for the years ended December 31, 2015, 2014, and 2013 was $142 million, $169 million and $157

million, respectively.

During the year ended December 31, 2015, the Company entered into an arrangement to sell its Penang, Malaysia

manufacturing operations, including the land, building, equipment, inventory, and employees to a contract manufacturer. During

the year ended December 31, 2015, the Company recognized an impairment loss of $6 million on the building within Other

charges in its consolidated statements of operations, and presented the assets as held for sale in its consolidated balance

sheets. The sale of the Penang, Malaysia facility and manufacturing operations was completed on February 1, 2016.

During the year ended December 31, 2015, the Company entered into an agreement to broker the sale of its corporate

aircraft. During the year ended December 31, 2015, the Company recognized an impairment loss of $31 million within Other

charges based on the indicated market value of the aircraft and presented the aircraft as held for sale in its consolidated balance

sheets.

Investments

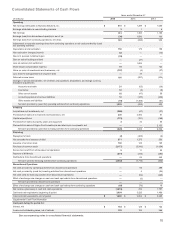

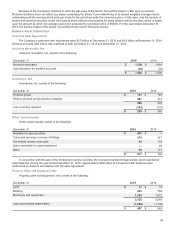

Investments consist of the following:

December 31, 2015 Cost Basis

Unrealized

Gains

Unrealized

Loss Investments

Available-for-sale securities:

Government, agency, and government-sponsored

enterprise obligations $ 455 $ — $ (11) $ 444

Corporate bonds 7— — 7

Common stock and equivalents —6 — 6

462 6 (11) 457

Other investments, at cost 203 — — 203

Equity method investments 9— — 9

674 6 (11) 669

Less: current portion of available-for-sale securities 401

$268

In December 2015, the Company invested $401 million in United Kingdom treasury securities in order to partially offset the

risk associated with fluctuations in the British Pound Sterling in the period before the closing of the purchase of Airwave. The

Company liquidated these investments in February 2016 to partially fund the acquisition of Airwave. The investments are

recorded within Other current assets in the Company's consolidated balance sheets.

December 31, 2014 Cost Basis

Unrealized

Gains Investments

Available-for-sale securities:

Government, agency, and government-sponsored enterprise obligations $14$— 14

Corporate bonds 16 — 16

Mutual funds 2— 2

Common stock and equivalents 17071

33 70 103

Other investments, at cost 191 — 191

Equity method investments 22 — 22

$ 246 $ 70 $ 316

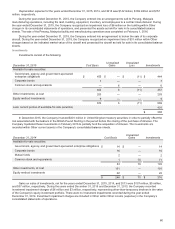

Gains on sales of investments, net for the years ended December 31, 2015, 2014, and 2013 were $107 million, $5 million,

and $37 million, respectively. During the years ended December 31, 2015 and December 31, 2013, the Company recorded

investment impairment charges of $6 million and $3 million, respectively, representing other-than-temporary declines in the value

of the Company’s equity investment portfolio. There were no investment impairments recorded during the year ended

December 31, 2014. Investment impairment charges are included in Other within Other income (expense) in the Company’s

consolidated statements of operations.