Motorola 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Financing Activities

Net cash used for financing activities was $2.4 billion in 2015 compared to $1.7 billion in 2014 and $842 million in 2013.

Cash used for financing activities in 2015 was primarily comprised of: (i) $3.2 billion used for purchases of common stock under

our share repurchase program and (ii) $277 million of cash used for the payment of dividends, partially offset by: (i) $971 million

of net proceeds from the issuance of the Senior Convertible Notes and (ii) $100 million of net proceeds from the issuance of

common stock in connection with our employee stock option and employee stock purchase plans.

Cash used for financing activities in 2014 was primarily comprised of: (i) $2.5 billion used for purchases of our common

stock under our share repurchase program, (ii) $465 million of cash used for the repayment of debt, and (iii) $318 million of cash

used for the payment of dividends, partially offset by: (i) $1.4 billion of net proceeds from the issuance of debt, (ii) $135 million of

net proceeds from the issuance of common stock in connection with our employee stock option and employee stock purchase

plans, and (iii) $93 million of distributions received from discontinued operations.

Cash used for financing activities in 2013 was primarily comprised of: (i) $1.7 billion used for purchases of our common

stock under our share repurchase program and (ii) $292 million of cash used for the payment of dividends, partially offset by: (i)

$593 million of net proceeds from the issuance of debt, (ii) $365 million of distributions received from discontinued operations,

and (iii) $165 million of net proceeds from the issuance of common stock in connection with our employee stock option and

employee stock purchase plans.

Current and Long-Term Debt: We had outstanding long-term debt of $4.4 billion and $3.4 billion, including the current

portions of $4 million, at December 31, 2015 and December 31, 2014, respectively.

On August 25, 2015, the Company entered into an agreement with Silver Lake Partners to issue $1.0 billion of 2% Senior

Convertible Notes which mature in September 2020. Interest on these notes is payable semiannually. The notes are convertible

anytime on or after two years from their issuance date, except in certain limited circumstances. The notes are convertible based

on a conversion rate of 14.5985 per $1,000 principal amount (which is equal to an initial conversion price of $68.50 per share).

In the event of conversion, the Company intends to settle the principal amount of the Senior Convertible Notes in cash.

During the year ended December 31, 2014, we redeemed $400 million aggregate principal amount outstanding of our

6.000% Senior Notes due November 2017 for an aggregate purchase price of approximately $456 million. After accelerating the

amortization of debt issuance costs, debt discounts, and hedge adjustments, we recognized a loss of $37 million related to the

redemption within Other income (expense) in the consolidated statements of operations. During the year ended December 31,

2014, we issued an aggregate principal amount of $1.4 billion consisting of: (i) $600 million of 4.000% Senior Notes due 2024, of

which, after debt issuance costs and debt discounts, we recognized net proceeds of $583 million, (ii) $400 million of 3.500%

Senior Notes due 2021, of which, after debt issuance costs and debt discounts, we recognized net proceeds of $393 million, and

(iii) $400 million of 5.500% Senior notes due 2044, of which, after debt issuance costs and debt discounts, we recognized net

proceeds of $394 million.

During 2013, we issued an aggregate principal amount of $600 million of 3.50% Senior Notes due March 1, 2023,

recognizing net proceeds of $588 million, after debt discount and issuance costs.

We have investment grade ratings on our senior unsecured long-term debt from the three largest U.S. national rating

agencies. On August 5, 2015, our corporate credit and senior unsecured long-term debt ratings were downgraded by two of the

three rating agencies in connection with our capital structure activities. Moody's Investors Service downgraded its Baa2 rating to

Baa3 and changed its outlook from stable to negative. Standard & Poor’s Rating Services downgraded its BBB rating to BBB-

and maintained its stable outlook. Fitch Ratings confirmed its BBB rating on August 5, 2015 but changed its outlook to negative

from stable. We continue to believe that we will be able to maintain sufficient access to the capital markets. Any future

disruptions, uncertainty, or volatility in the capital markets or deterioration in our credit ratings may result in higher funding costs

for us and adversely affect our ability to access funds.

In connection with the completion of the acquisition of Airwave, we entered into a new term loan credit agreement (the

“Term Loan Agreement”), under which we borrowed a term loan (the “Term Loan”) with an initial principal amount of $675 million.

Interest on the Term Loan is variable and indexed to LIBOR. No additional borrowings are permitted under the Term Loan

Agreement and amounts borrowed and repaid or prepaid may not be re-borrowed. Our borrowing capacity under the 2014

Motorola Solutions Credit Agreement may be partially limited at the end of the first quarter of 2016 due to the additional

indebtedness incurred in connection with the Term Loan. However, we believe we will continue to have sufficient liquidity to

operate our business.

We may, from time to time, seek to retire certain of our outstanding debt through open market cash purchases, privately-

negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing market conditions, our liquidity

requirements, contractual restrictions and other factors.

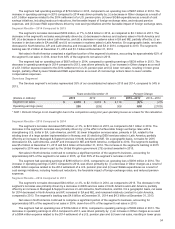

Share Repurchase Program: Through actions taken on July 28, 2011, January 30, 2012, July 25, 2012, July 22, 2013,

and November 4, 2014, the Board of Directors has authorized an aggregate share repurchase amount of up to $12.0 billion of

our outstanding shares of common stock (the “share repurchase program”). The share repurchase program does not have an

expiration date. As of December 31, 2015, we have used approximately $11.0 billion of the share repurchase authority, including

transaction costs, to repurchase shares, leaving approximately $1.0 billion of authority available for future repurchases.

On August 4, 2015, the Board of Directors authorized the Company to commence a modified "Dutch auction" tender offer

to repurchase up to $2.0 billion of its outstanding shares of common stock. The repurchase of these shares was authorized

under the existing share repurchase authority. The tender offer commenced on August 7, 2015 and expired on September 3,