Motorola 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”), which permits the Company to offer

eligible employees severance benefits based on years of service and employment grade level in the event that employment is

involuntarily terminated as a result of a reduction-in-force or restructuring. The Severance Plan includes defined formulas to

calculate employees’ termination benefits. In addition to the Involuntary Severance Plan, during the year ended December 31,

2013, the Company accepted voluntary applications to its Severance Plan from a defined subset of employees within the United

States. Voluntary applicants received termination benefits based on the formulas defined in the Severance Plan. However,

termination benefits, which are normally capped at six months of salary, were capped at a full year’s salary.

The Company recognizes termination benefits based on formulas per the Severance Plan at the point in time that future

settlement is probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan is

approved by management. Exit costs consist of future minimum lease payments on vacated facilities and other contractual

terminations. At each reporting date, the Company evaluates its accruals for employee separation and exit costs to ensure the

accruals are still appropriate. In certain circumstances, accruals are no longer needed because of efficiencies in carrying out the

plans or because employees previously identified for separation resigned from the Company and did not receive severance, or

were redeployed due to circumstances not foreseen when the original plans were approved. In these cases, the Company

reverses accruals through the consolidated statements of operations where the original charges were recorded when it is

determined they are no longer needed.

During 2015, 2014, and 2013 the Company continued to implement various productivity improvement plans aimed at

achieving long-term, sustainable profitability by driving efficiencies and reducing operating costs. Both of the Company’s

segments were impacted by these plans. The employees affected were located in all geographic regions.

2015 Charges

During 2015, the Company recorded net reorganization of business charges of $117 million, including $9 million of charges

in Costs of sales and $108 million of charges in Other charges in the Company’s consolidated statements of operations.

Included in the $117 million were charges of: (i) $74 million for employee separation costs, (ii) $31 million for the impairment of

the corporate aircraft, (iii) $10 million for exit costs, and (iv) a $6 million building impairment charge, partially offset by $4 million

of reversals of accruals no longer needed.

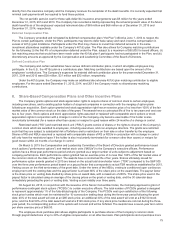

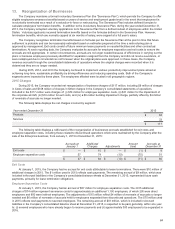

The following table displays the net charges incurred by segment:

Year ended December 31 2015

Products $84

Services 33

$117

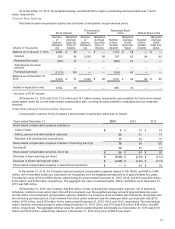

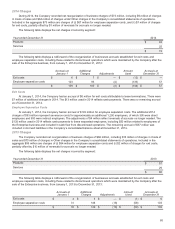

The following table displays a rollforward of the reorganization of businesses accruals established for exit costs and

employee separation costs, including those related to discontinued operations which were maintained by the Company after the

sale of the Enterprise business, from January 1, 2015 to December 31, 2015:

Accruals at

January 1

Additional

Charges Adjustments

Amount

Used

Accruals at

December 31

Exit costs $ — $ 10 $ — $ (1) $ 9

Employee separation costs 57 74 (10) (70) 51

$ 57 $ 84 $ (10) $ (71) $ 60

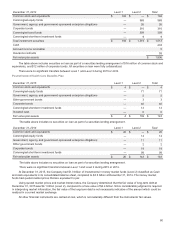

Exit Costs

At January 1, 2015, the Company had no accrual for exit costs attributable to lease terminations. There were $10 million of

additional charges in 2015. The $1 million used in 2015 reflects cash payments. The remaining accrual of $9 million, which was

included in Accrued liabilities in the Company’s consolidated balance sheets at December 31, 2015, represented future cash

payments, primarily for lease termination obligations.

Employee Separation Costs

At January 1, 2015, the Company had an accrual of $57 million for employee separation costs. The 2015 additional

charges of $74 million represent severance costs for approximately an additional 1,100 employees, of which 200 were direct

employees and 900 were indirect employees. The adjustments of $10 million reflect $4 million of reversals of accruals no longer

needed and $6 million of reversals of accruals held for employees separated from discontinued operations. The $70 million used

in 2015 reflects cash payments to severed employees. The remaining accrual of $51 million, which is included in Accrued

liabilities in the Company’s consolidated balance sheet at December 31, 2015, is expected to be paid, generally, within one year

to: (i) severed employees who have already begun to receive payments and (ii) approximately 300 employees to be separated in

2016.