Motorola 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

2015. The Company paid $2.0 billion, including transaction costs, to repurchase approximately 30.1 million shares at a tender

price of $66.50 per share.

We paid an aggregate of $3.2 billion during 2015, including transaction costs, to repurchase approximately 48.0 million

shares at an average price of $66.22 per share. During 2014, we paid an aggregate of $2.5 billion, including transaction costs, to

repurchase approximately 39.4 million shares at an average price of $64.63 per share. During 2013, we paid an aggregate of

$1.7 billion, including transaction costs, to repurchase approximately 28.6 million shares at an average price of $59.30 per

share. All repurchased shares have been retired.

Payment of Dividends: We paid cash dividends to holders of our common stock of $277 million in 2015, $318 million in

2014, and $292 million in 2013.

Credit Facilities

As of December 31, 2015, we had a $2.1 billion unsecured syndicated revolving credit facility (the “2014 Motorola

Solutions Credit Agreement”) scheduled to mature on May 29, 2019. We must comply with certain customary covenants,

including maximum leverage ratio as defined in the 2014 Motorola Solutions Credit Agreement. We were in compliance with our

financial covenants as of December 31, 2015. We did not borrow under the 2014 Motorola Solutions Credit Agreement during

the twelve months ended December 31, 2015.

As of December 31, 2015, we had a letter of credit sub-limit of $450 million under the 2014 Motorola Solutions Credit

Agreement. No letters of credit were issued under the revolving credit facility as of December 31, 2015.

Contractual Obligations and Other Purchase Commitments

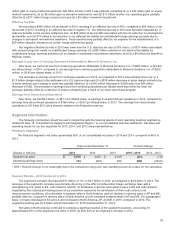

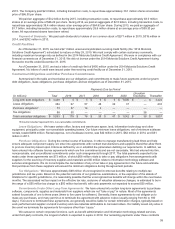

Summarized in the table and text below are our obligations and commitments to make future payments under long-term

debt obligations, lease obligations, purchase obligations and tax obligations as of December 31, 2015.

Payments Due by Period

(in millions) Total 2016 2017 2018 2019 2020

Uncertain

Timeframe Thereafter

Long-term debt obligations $4,448$4$5$5$5$1,005$ —$3,424

Lease obligations 484 67 57 48 42 37 — 233

Purchase obligations* 73 57 14 2 — — — —

Tax obligations 8850———— 38 —

Total contractual obligations $ 5,093 $ 178 $ 76 $ 55 $ 47 $ 1,042 $ 38 $ 3,657

*Amounts included represent firm, non-cancelable commitments.

Lease Obligations: We lease certain office, factory and warehouse space, land, information technology and other

equipment, principally under non-cancelable operating leases. Our future minimum lease obligations, net of minimum sublease

rentals, totaled $484 million. Rental expense, net of sublease income, was $42 million in 2015, $62 million in 2014, and $51

million in 2013.

Purchase Obligations: During the normal course of business, in order to manage manufacturing lead times and help

ensure adequate component supply, we enter into agreements with contract manufacturers and suppliers that either allow them

to procure inventory based upon criteria as defined by us or establish the parameters defining our requirements. In addition, we

have entered into software license agreements which are firm commitments and are not cancelable. We had entered into firm,

noncancelable, and unconditional commitments under such arrangements through 2017. The total payments expected to be

made under these agreements are $73 million, of which $68 million relate to take or pay obligations from arrangements with

suppliers for the sourcing of inventory supplies and materials and $5 million relate to information technology software and

services arrangements. We do not anticipate the cancellation of any of our take or pay agreements in the future and estimate

that purchases from these suppliers will exceed the minimum obligations during the agreement periods.

Tax Obligations: We have approximately $88 million of unrecognized income tax benefits relating to multiple tax

jurisdictions and tax years. Based on the potential outcome of our global tax examinations, or the expiration of the statute of

limitations for specific jurisdictions, it is reasonably possible that the unrecognized tax benefits will change within the next twelve

months. The associated net tax impact on the effective tax rate, exclusive of valuation allowance changes, is estimated to be in

the range of a $50 million tax charge to a $50 million tax benefit, with cash payments not expected to exceed $30 million.

Commitments Under Other Long-Term Agreements: We have entered into certain long-term agreements to purchase

software, components, supplies and materials from suppliers which are not "take or pay" in nature. Most of the agreements

extend for periods of one to three years (three to five years for software). Generally, these agreements do not obligate us to

make any purchases, and many permit us to terminate the agreement with advance notice (usually ranging from 60 to 180

days). If we were to terminate these agreements, we generally would be liable for certain termination charges, typically based on

work performed and supplier on-hand inventory and raw materials attributable to canceled orders. Our liability would only arise in

the event we terminate the agreements for reasons other than “cause.”

We outsource certain corporate functions, such as benefit administration and information technology-related services,

under third-party contracts, the longest of which is expected to expire in 2019. Our remaining payments under these contracts